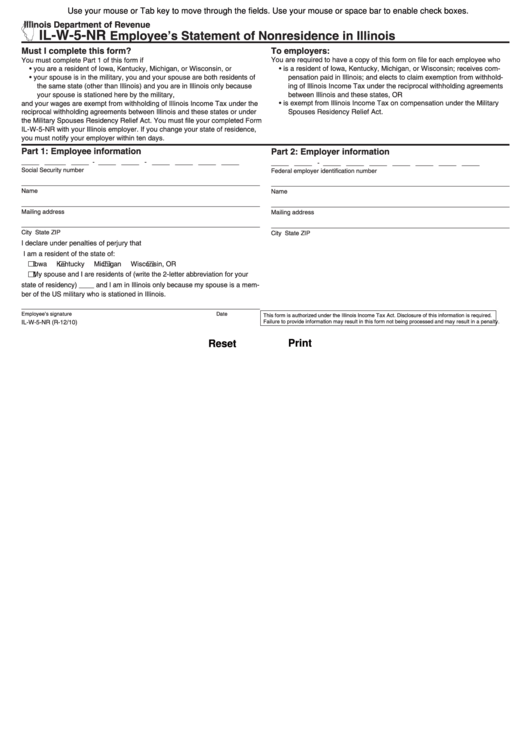

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

IL-W-5-NR

Employee’s Statement of Nonresidence in Illinois

Must I complete this form?

To employers:

You must complete Part 1 of this form if

You are required to have a copy of this form on file for each employee who

• you are a resident of Iowa, Kentucky, Michigan, or Wisconsin, or

• is a resident of Iowa, Kentucky, Michigan, or Wisconsin; receives com-

• your spouse is in the military, you and your spouse are both residents of

pensation paid in Illinois; and elects to claim exemption from withhold-

the same state (other than Illinois) and you are in Illinois only because

ing of Illinois Income Tax under the reciprocal withholding agreements

your spouse is stationed here by the military,

between Illinois and these states, OR

and your wages are exempt from withholding of Illinois Income Tax under the

• is exempt from Illinois Income Tax on compensation under the Military

reciprocal withholding agreements between Illinois and these states or under

Spouses Residency Relief Act.

the Military Spouses Residency Relief Act. You must file your completed Form

IL-W-5-NR with your Illinois employer. If you change your state of residence,

you must notify your employer within ten days.

Part 1: Employee information

Part 2: Employer information

_____ ______ _____ - _____ _____ - _____ _____ _____ _____

_____ _____ - _____ _____ _____ _____ _____ _____ _____

Social Security number

Federal employer identification number

______________________________________________________________________

______________________________________________________________________

Name

Name

______________________________________________________________________

______________________________________________________________________

Mailing address

Mailing address

______________________________________________________________________

______________________________________________________________________

City

State

ZIP

City

State

ZIP

I declare under penalties of perjury that

I am a resident of the state of:

Iowa

Kentucky

Michigan

Wisconsin, OR

My spouse and I are residents of (write the 2-letter abbreviation for your

state of residency) ____ and I am in Illinois only because my spouse is a mem-

ber of the US military who is stationed in Illinois.

______________________________________________________________________

Employee’s signature

Date

This form is authorized under the Illinois Income Tax Act. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

IL-W-5-NR (R-12/10)

Reset

Print

1

1