Dol Form 25 - Wage Statement

Download a blank fillable Dol Form 25 - Wage Statement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Dol Form 25 - Wage Statement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

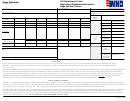

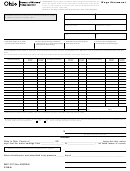

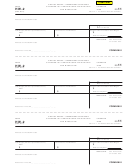

Department of Labor, Workers’

DOL FORM 25

(Rev. 1/2018)

Workers’ Compensation

PO Box 488

State File No.

Montpelier, VT 05601-0488

Ins. Co. File No.

(802) 828-2286; TDD 800-650-4152

Date of Injury

Fed. ID No.

WAGE STATEMENT – For injuries occurring on or after July 1, 2008

Employee:

Employer:

Wage Rate:

$

per

Number of Days Hired to Work:

Number of Hours Hired to Work:

Week Ending

Number

Gross Wages

Extras (as in 6 or 7)

INSTRUCTIONS:

of

Please indicate what the

Read Carefully

Hours

extra is, for example,

Month

Day

Year

or Days

$1000.00 bonus

1. Enter GROSS wages of employee

Worked

for 26 weeks before date of accident

(NOT take-home pay).

1

2. Do not include the week of the

2

accident.

3

3. Leave blank those weeks in which

the employee had excused absences

4

for which he/she was paid for less

5

than ½ of a work week.

6

4. Leave blank those weeks in which

you had reduced operations or a plant

7

shutdown and for which the employee

8

was paid for less than ½ of a work

week.

9

5. Do not enter those weeks in which

10

an employee was on vacation for more

11

than ½ of a work week.

6. If room, board, lodging or other

12

“extras” (electricity, fuel, etc.) are

13

provided in addition to monetary

wages, break these down into a

14

weekly value, and include and

15

describe the income in the column

16

marked “EXTRAS.” This includes

tips if not included in gross wages.

17

7. Include any bonuses and

18

commissions paid to the employee in

19

addition to wages in the column

marked “EXTRAS.”

20

8. Enter the dates when your normal

21

work week ends (not the date a check

is issued to the employee) and the

22

number of hours or days worked.

23

24

25

26

When did the employee begin losing time?

Was the employee paid in full for the day of the accident?

Are employee’s wages subject to any child support withholding order?

Yes

No

If yes, in what amount?

$

per

Day of the week the check will be mailed to the claimant or deposited in the claimant’s account

This is a correct statement of the employee’s earnings as taken from the employer’s payroll records.

By:

Position Title:

Signature of Preparer

Print Name:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1