Form 15h - Declaration

ADVERTISEMENT

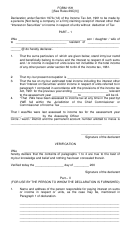

FORM NO. 15H

[See section 197A(1C), and rule 29C(1A)]

Declaration under section 197A(1C) of the Income-tax Act, 1961 to be made by an individual who is of the age of sixty years or more claiming certain receipts without deduction of tax.

PART I

2. PAN of the Assessee

1. Name of Assessee (Declarant)

4. Assessment Year

3. Age

(for which declaration is being made)

5. Flat/Door/Block No.

6. Name of Premises

7. Assessed in which Ward/Circle

10. AO Code

(under whom assessed

8. Road/Street/Lane

9. Area/Locality

last time)

Area Code

AO Type

Range Code

AO No.

11. Town/City/District

12. State

13. PIN

14. Last Assessment Year

in which assessed

15. Email

16. Telephone No. (with STD Code) and Mobile No.

17. Present Ward/Circle

18. Name of Business/Occupupation

19. Present AO Code

(if not same as

above)

Area Code

AO Type

Range Code

AO No.

20. Jurisdictional Chief Commissioner of Income-tax or Commissioner of Income-tax

(if not assessed to

Income-tax earlier)

21.Estimated total income from the sources mentioned below:

(Please tick the relevant box)

Dividend from shares referred to in Schedule I

Interest on securities referred to in Schedule II

Interest on sums referred to in Schedule III

Income form units referred to in Schedule IV

The amount of withdrawal referred to in clause (a) of sub-section 2 of section 80CCA referred to in Schedule V

22.Estimated total income of the previous year in which income mentioned in Column 21 is to be included

23. Details of investments in respect of which the declaration is being made:

SCHEDULE-I

(Details of shares, which stand in the name of the declarant and beneficially owned by him)

Date(s) on which the shares were acquired

Class of shares & face

No. of shares

Total value of shares

Distinctive numbers of the shares

by the declarant (dd/mm/yyyy)

value of each share

SCHEDULE-II

(Details of the securities held in the name of declarant and beneficially owned by him)

Date(s) on which the securities were acquired

Description of securities

Number of securities

Amount of securities

Date(s) of securities (dd/mm/yyyy)

by the declarant (dd/mm/yyyy)

SCHEDULE-III

(Details of the sums given by the declarant on interest)

Name and address of the person to whom

Amount of sums

Date on which the sums were given on

Period for which sums were

Rate of interest

the sums are given on interest

given on interest

interest(dd/mm/yyyy)

given on interest

SCHEDULE-IV

(Details of the mutual fund units held in the name of declarant and beneficially owned by him)

Name and address of the

Number of

Class of units and face

Distinctive number of units

Income in respect of units

mutual fund

units

value of each unit

SCHEDULE-V

(Details of the withdrawal made from National Savings Scheme)

Particulars of the Post Office where the account under the National Savings Scheme

Date on which the account

The amount of withdrawal

is maintained and the account number

was opened(dd/mm/yyyy)

from the account

Signature of the Declarant

Declaration/Verification

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2