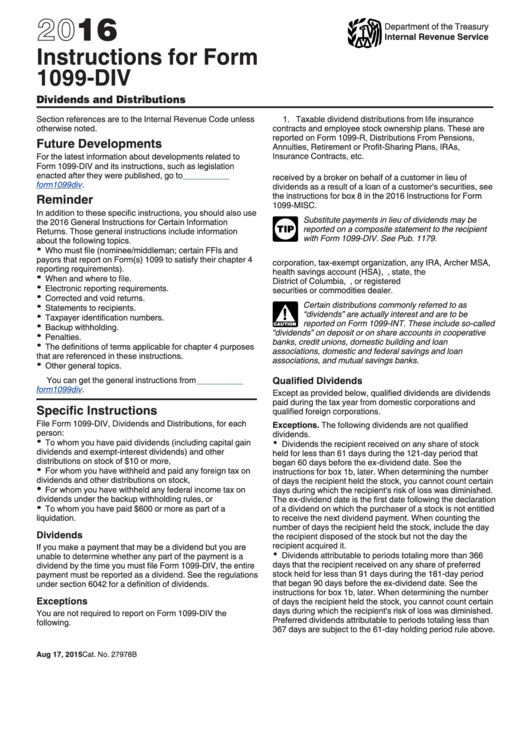

Instructions For Form 1099-Div - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form

1099-DIV

Dividends and Distributions

Section references are to the Internal Revenue Code unless

1. Taxable dividend distributions from life insurance

otherwise noted.

contracts and employee stock ownership plans. These are

reported on Form 1099-R, Distributions From Pensions,

Future Developments

Annuities, Retirement or Profit-Sharing Plans, IRAs,

Insurance Contracts, etc.

For the latest information about developments related to

Form 1099-DIV and its instructions, such as legislation

2. Substitute payments in lieu of dividends. For payments

enacted after they were published, go to

received by a broker on behalf of a customer in lieu of

form1099div.

dividends as a result of a loan of a customer's securities, see

the instructions for box 8 in the 2016 Instructions for Form

Reminder

1099-MISC.

In addition to these specific instructions, you should also use

Substitute payments in lieu of dividends may be

the 2016 General Instructions for Certain Information

reported on a composite statement to the recipient

Returns. Those general instructions include information

TIP

with Form 1099-DIV. See Pub. 1179.

about the following topics.

Who must file (nominee/middleman; certain FFIs and U.S.

3. Payments made to certain payees. These include a

payors that report on Form(s) 1099 to satisfy their chapter 4

corporation, tax-exempt organization, any IRA, Archer MSA,

reporting requirements).

health savings account (HSA), U.S. agency, state, the

When and where to file.

District of Columbia, U.S. possession, or registered

Electronic reporting requirements.

securities or commodities dealer.

Corrected and void returns.

Certain distributions commonly referred to as

Statements to recipients.

“dividends” are actually interest and are to be

!

Taxpayer identification numbers.

reported on Form 1099-INT. These include so-called

Backup withholding.

CAUTION

“dividends” on deposit or on share accounts in cooperative

Penalties.

banks, credit unions, domestic building and loan

The definitions of terms applicable for chapter 4 purposes

associations, domestic and federal savings and loan

that are referenced in these instructions.

associations, and mutual savings banks.

Other general topics.

Qualified Dividends

You can get the general instructions from

form1099div.

Except as provided below, qualified dividends are dividends

paid during the tax year from domestic corporations and

Specific Instructions

qualified foreign corporations.

File Form 1099-DIV, Dividends and Distributions, for each

Exceptions. The following dividends are not qualified

person:

dividends.

To whom you have paid dividends (including capital gain

Dividends the recipient received on any share of stock

dividends and exempt-interest dividends) and other

held for less than 61 days during the 121-day period that

distributions on stock of $10 or more,

began 60 days before the ex-dividend date. See the

For whom you have withheld and paid any foreign tax on

instructions for box 1b, later. When determining the number

dividends and other distributions on stock,

of days the recipient held the stock, you cannot count certain

For whom you have withheld any federal income tax on

days during which the recipient's risk of loss was diminished.

dividends under the backup withholding rules, or

The ex-dividend date is the first date following the declaration

of a dividend on which the purchaser of a stock is not entitled

To whom you have paid $600 or more as part of a

liquidation.

to receive the next dividend payment. When counting the

number of days the recipient held the stock, include the day

Dividends

the recipient disposed of the stock but not the day the

recipient acquired it.

If you make a payment that may be a dividend but you are

Dividends attributable to periods totaling more than 366

unable to determine whether any part of the payment is a

days that the recipient received on any share of preferred

dividend by the time you must file Form 1099-DIV, the entire

stock held for less than 91 days during the 181-day period

payment must be reported as a dividend. See the regulations

that began 90 days before the ex-dividend date. See the

under section 6042 for a definition of dividends.

instructions for box 1b, later. When determining the number

Exceptions

of days the recipient held the stock, you cannot count certain

days during which the recipient's risk of loss was diminished.

You are not required to report on Form 1099-DIV the

Preferred dividends attributable to periods totaling less than

following.

367 days are subject to the 61-day holding period rule above.

Aug 17, 2015

Cat. No. 27978B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4