Instructions For Form 8802 (Rev. November 2015)

ADVERTISEMENT

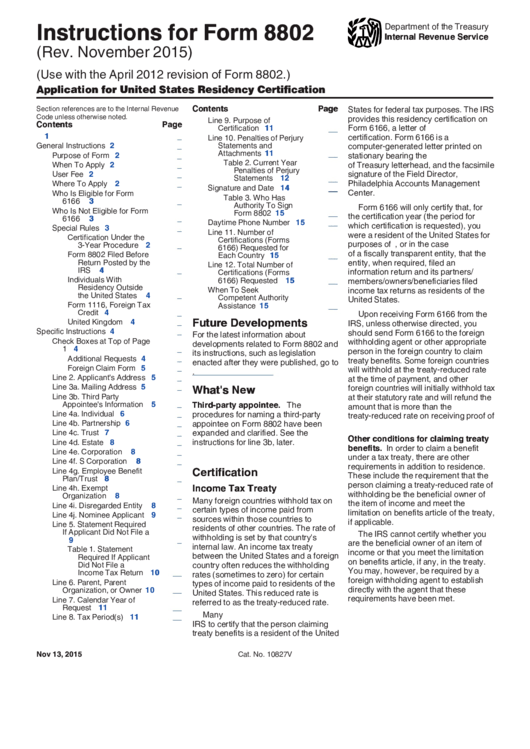

Instructions for Form 8802

Department of the Treasury

Internal Revenue Service

(Rev. November 2015)

(Use with the April 2012 revision of Form 8802.)

Application for United States Residency Certification

Contents

Page

States for federal tax purposes. The IRS

Section references are to the Internal Revenue

Code unless otherwise noted.

provides this residency certification on

Line 9. Purpose of

Contents

Page

Form 6166, a letter of U.S. residency

Certification . . . . . . . . . . . .

11

U.S. Residency Certification . . . . . . .

1

certification. Form 6166 is a

Line 10. Penalties of Perjury

Statements and

General Instructions . . . . . . . . . . . . .

2

computer-generated letter printed on

Attachments . . . . . . . . . . . .

11

Purpose of Form . . . . . . . . . . . .

2

stationary bearing the U.S. Department

Table 2. Current Year

When To Apply . . . . . . . . . . . . .

2

of Treasury letterhead, and the facsimile

Penalties of Perjury

signature of the Field Director,

User Fee . . . . . . . . . . . . . . . . .

2

Statements . . . . . . . . .

12

Philadelphia Accounts Management

Where To Apply . . . . . . . . . . . .

2

Signature and Date . . . . . . . . .

14

Center.

Who Is Eligible for Form

Table 3. Who Has

6166

. . . . . . . . . . . . . . . . .

3

Authority To Sign

Form 6166 will only certify that, for

Who Is Not Eligible for Form

Form 8802 . . . . . . . . . .

15

the certification year (the period for

6166

. . . . . . . . . . . . . . . . .

3

Daytime Phone Number . . . . . .

15

which certification is requested), you

Special Rules . . . . . . . . . . . . . .

3

Line 11. Number of

were a resident of the United States for

Certification Under the

Certifications (Forms

purposes of U.S. taxation, or in the case

3-Year Procedure . . . . . .

2

6166) Requested for

of a fiscally transparent entity, that the

Form 8802 Filed Before

Each Country . . . . . . . . . . .

15

entity, when required, filed an

Return Posted by the

Line 12. Total Number of

IRS . . . . . . . . . . . . . . .

4

information return and its partners/

Certifications (Forms

Individuals With

6166) Requested . . . . . . . .

15

members/owners/beneficiaries filed

Residency Outside

When To Seek U.S.

income tax returns as residents of the

the United States

. . . . . .

4

Competent Authority

United States.

Form 1116, Foreign Tax

Assistance . . . . . . . . . . . . .

15

Credit . . . . . . . . . . . . . .

4

Upon receiving Form 6166 from the

Future Developments

United Kingdom . . . . . . . . .

4

IRS, unless otherwise directed, you

Specific Instructions . . . . . . . . . . . . .

4

should send Form 6166 to the foreign

For the latest information about

Check Boxes at Top of Page

withholding agent or other appropriate

developments related to Form 8802 and

1 . . . . . . . . . . . . . . . . . . . .

4

person in the foreign country to claim

its instructions, such as legislation

Additional Requests . . . . . . .

4

treaty benefits. Some foreign countries

enacted after they were published, go to

Foreign Claim Form . . . . . . .

5

will withhold at the treaty-reduced rate

Line 2. Applicant's Address . . . . .

5

at the time of payment, and other

Line 3a. Mailing Address . . . . . . .

5

What's New

foreign countries will initially withhold tax

Line 3b. Third Party

at their statutory rate and will refund the

Appointee's Information . . . . .

5

Third-party appointee. The

amount that is more than the

Line 4a. Individual . . . . . . . . . . .

6

procedures for naming a third-party

treaty-reduced rate on receiving proof of

Line 4b. Partnership . . . . . . . . . .

6

appointee on Form 8802 have been

U.S. residency.

Line 4c. Trust . . . . . . . . . . . . . .

7

expanded and clarified. See the

Other conditions for claiming treaty

instructions for line 3b, later.

Line 4d. Estate . . . . . . . . . . . . .

8

benefits. In order to claim a benefit

Line 4e. Corporation . . . . . . . . .

8

under a tax treaty, there are other

U.S. Residency

Line 4f. S Corporation

. . . . . . . .

8

requirements in addition to residence.

Certification

Line 4g. Employee Benefit

These include the requirement that the

Plan/Trust . . . . . . . . . . . . . .

8

person claiming a treaty-reduced rate of

Income Tax Treaty

Line 4h. Exempt

withholding be the beneficial owner of

Organization . . . . . . . . . . . .

8

Many foreign countries withhold tax on

the item of income and meet the

Line 4i. Disregarded Entity

. . . . .

8

certain types of income paid from

limitation on benefits article of the treaty,

Line 4j. Nominee Applicant . . . . .

9

sources within those countries to

if applicable.

Line 5. Statement Required

residents of other countries. The rate of

If Applicant Did Not File a

The IRS cannot certify whether you

withholding is set by that country's

U.S. Income Tax Return . . . . .

9

are the beneficial owner of an item of

internal law. An income tax treaty

Table 1. Statement

income or that you meet the limitation

between the United States and a foreign

Required If Applicant

on benefits article, if any, in the treaty.

country often reduces the withholding

Did Not File a U.S.

You may, however, be required by a

Income Tax Return . . . .

10

rates (sometimes to zero) for certain

foreign withholding agent to establish

Line 6. Parent, Parent

types of income paid to residents of the

directly with the agent that these

Organization, or Owner . . . . .

10

United States. This reduced rate is

requirements have been met.

Line 7. Calendar Year of

referred to as the treaty-reduced rate.

Request . . . . . . . . . . . . . .

11

Many U.S. treaty partners require the

Line 8. Tax Period(s) . . . . . . . .

11

IRS to certify that the person claiming

treaty benefits is a resident of the United

Nov 13, 2015

Cat. No. 10827V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16