Notice Of Assessment Lien

ADVERTISEMENT

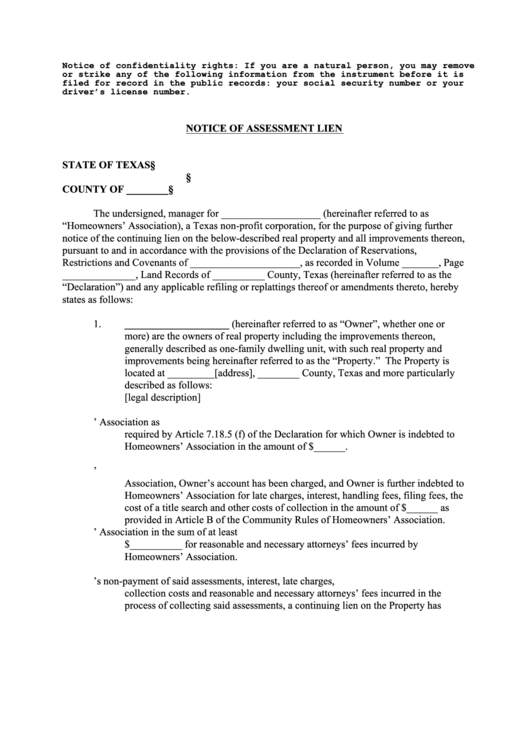

Notice of confidentiality rights: If you are a natural person, you may remove

or strike any of the following information from the instrument before it is

filed for record in the public records: your social security number or your

driver’s license number.

NOTICE OF ASSESSMENT LIEN

STATE OF TEXAS

§

§

COUNTY OF ________

§

The undersigned, manager for ___________________ (hereinafter referred to as

“Homeowners’ Association), a Texas non-profit corporation, for the purpose of giving further

notice of the continuing lien on the below-described real property and all improvements thereon,

pursuant to and in accordance with the provisions of the Declaration of Reservations,

Restrictions and Covenants of _____________________, as recorded in Volume _______, Page

______________, Land Records of __________ County, Texas (hereinafter referred to as the

“Declaration”) and any applicable refiling or replattings thereof or amendments thereto, hereby

states as follows:

1.

____________________ (hereinafter referred to as “Owner”, whether one or

more) are the owners of real property including the improvements thereon,

generally described as one-family dwelling unit, with such real property and

improvements being hereinafter referred to as the “Property.” The Property is

located at _________[address], ________ County, Texas and more particularly

described as follows:

[legal description]

2.

Owner has failed to pay certain assessments to Homeowners’ Association as

required by Article 7.18.5 (f) of the Declaration for which Owner is indebted to

Homeowners’ Association in the amount of $______.

3.

As a consequence of Owner failing to pay such assessments to Homeowners’

Association, Owner’s account has been charged, and Owner is further indebted to

Homeowners’ Association for late charges, interest, handling fees, filing fees, the

cost of a title search and other costs of collection in the amount of $______ as

provided in Article B of the Community Rules of Homeowners’ Association.

4.

Owner is further indebted to Homeowners’ Association in the sum of at least

$__________ for reasonable and necessary attorneys’ fees incurred by

Homeowners’ Association.

5.

As a result of Owner’s non-payment of said assessments, interest, late charges,

collection costs and reasonable and necessary attorneys’ fees incurred in the

process of collecting said assessments, a continuing lien on the Property has

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2