KINDAH FOUNDATION POLICY

RULES AND REGULATIONS:

Gifts in kind are important way of benefiting

Kindah Foundation through charitable gift to

DEFINITION

Kindah Foundation. Gifts in kind include donations

A Gift-In-Kind is a voluntary contribution of goods or services that can be used to

of property other than cash and marketable

advance the mission of Kindah Foundation or can be readily converted to cash and may

securities such as real estate, works of art, books,

equipment, furnishings, software and licensing.

qualify as a charitable deduction for the person(s) making the gift.

IN-KIND donations must meet the standard

Note: Contributed services cannot be counted as a gift and do not qualify as a

charitable organization rules as outlined by the

charitable tax deduction to the donor. However, a donor of services may be able to

Federal Accounting Standards Board (FASB)

which includes:

deduct expenses incurred while performing said services. In such cases, the donor

should be advised to consult with a tax accountant.

Current standards of the FASB require that

----------------------------------------------------------------------------------------------------------

contributed services be recognized and recorded.

You are strongly encouraged to consult with your tax advisor and refer to the IRS

The following criteria must be met: (1) the

publications referenced below:

donation must be useful; (2) the service creates or

enhances a non-financial asset; (3) the services

• To claim a tax deduction for in-kind gifts valued between $500 and $5,000, the donor must

require specialized skills and are provided by

complete Part I of IRS Form 8232.

individuals with those skills.

• For gifts that exceed $5,000, the donor must.

▪ Complete ALL parts of IRS Form 8232 and submit the complete form to the Kindah Foundation

Providing IN-KIND services and materials require

for a signature.

review and approval from the Kindah Foundation

▪ Submit a certified appraisal dated no more than 60 days from the date of the donation. The

Treasurer prior to acceptance. Only signed,

appraisal must be prepared, signed and dated by a qualified, third-party appraiser.

approved donation forms are acceptable as

The value of any item, regardless of the amount, is used for internal gift reporting only—the

acknowledgement of in-kind donations.

Kindah Foundation is unable to include the estimated value on a donor receipt or

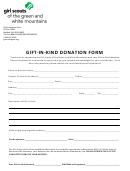

Instructions for completing the IN-KIND

acknowledgement. It is the responsibility of the donor to substantiate the fair market value for

DONATION FORM:

his/her own tax purposes.

1.

Provide specific project information related

What constitutes a qualified appraisal?

to the event being planned including date,

I. Appraiser must hold himself or herself out to the public as an appraiser and state credentials

city and county.

showing that he or she is qualified to appraise the type of property being valued.

2.

Provide detailed information related to the

II. Appraiser must value the property no more than 60 days before the date of gift; it can be done

description of the item or service being

donated. For printing donations, include

after the gift has been accepted by the Kindah Foundation.

specific number of pages, packets or other

III. Appraiser cannot be (1) the donor, (2) (Kindah Foundation), (3) any party to the transaction,

items that are being considered. For other

(4) an appraiser used regularly by (1), (2) or (3), or anyone employed or related to (1),(2), or (3).

material items, include specific quantities

being considered. No financial donations are

The appraisal must contain the following information:

considered in-kind donations.

1. A description of the item

3.

The Estimated Fair Market Value (FMV)

2. It’s physical condition

must be completed by the donor. The

3. The date (or expected date) of the contribution

Association cannot place a FMV amount or

4. Name, address and tax ID number of the appraiser

interpret the value of any non-financial

donations.

5. Qualifications of the appraiser including his/her background, experience and education

Provide donor-benefit amounts being

4.

6. A statement that the appraisal was prepared for income tax purposes

returned to the donor in exchange for their

7. Date the item was valued

in-kind donation

.

8. Appraised fair market value of the item

9. Method of valuation (income approach; market data approach; replacement cost minus

a.

EXAMPLE: A donor provided printing

depreciation approach.)

of 100 booklets for an Educational

10. Appraiser must complete Part IV of Section B on form 8283

Conference and received a dinner at

the event. The cost of the dinner must

be itemized and recorded.

The individual accepting the gift will sign and date the Gift-In-Kind form only after the donor has

5.

Provide information related to the donor

irrevocably turned over the gift-in-kind. Once signed, the form should be turned over to the

including name, organization, address and

Foundation immediately for processing and acknowledgement.

other contact information.

6.

Record the date received and your name.

Send the completed form to the Kindah

7.

Foundation, Inc., office for review and

approval. A copy of the completed,

approved form will be sent directly to the

NOTE

donor and one copy of all in-kind donation

Date Received: ____________________________

forms will be maintained at the Kindah

Foundation, Inc., office for audit purposes.

8.

Donations that cannot be accepted or fall

APPROVAL: ___________________________________

outside the standard guidelines for

acceptance will be rejected. A formal letter

DATE: _________________________________________

will be sent to the donor and a copy of the

notice will be retained for our records.

1

1 2

2