Employers Withholding Registration Form

ADVERTISEMENT

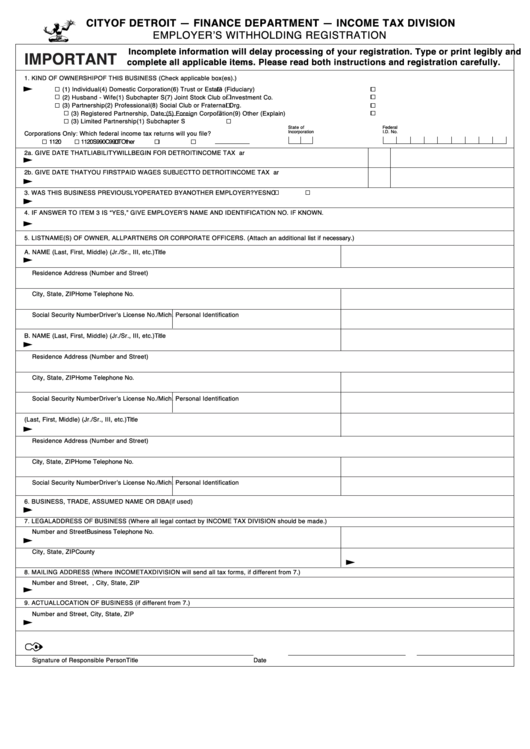

CITY OF DETROIT — FINANCE DEPARTMENT — INCOME TAX DIVISION

EMPLOYERʼS WITHHOLDING REGISTRATION

Incomplete information will delay processing of your registration. Type or print legibly and

IMPORTANT

complete all applicable items. Please read both instructions and registration carefully.

1. KIND OF OWNERSHIP OF THIS BUSINESS (Check applicable box(es).)

(1) Individual

(4) Domestic Corporation

(6) Trust or Estate (Fiduciary)

(2) Husband - Wife

(1) Subchapter S

(7) Joint Stock Club or Investment Co.

(3) Partnership

(2) Professional

(8) Social Club or Fraternal Org.

(3) Registered Partnership, Date:

(5) Foreign Corporation

(9) Other (Explain)

(3) Limited Partnership

(1) Subchapter S

State of

Federal

Incorporation

I.D. No.

Corporations Only: Which federal income tax returns will you file?

1120

1120S

990C

990T

Other

2a. GIVE DATE THAT LIABILITY WILL BEGIN FOR DETROIT INCOME TAX WITHHOLDING.

Mo.

Day

Year

2b. GIVE DATE THAT YOU FIRST PAID WAGES SUBJECT TO DETROIT INCOME TAX WITHHOLDING.

Mo.

Day

Year

3. WAS THIS BUSINESS PREVIOUSLY OPERATED BY ANOTHER EMPLOYER?

YES

NO

4. IF ANSWER TO ITEM 3 IS “YES,” GIVE EMPLOYERʼS NAME AND IDENTIFICATION NO. IF KNOWN.

5. LIST NAME(S) OF OWNER, ALL PARTNERS OR CORPORATE OFFICERS. (Attach an additional list if necessary.)

A. NAME (Last, First, Middle) (Jr./Sr., III, etc.)

Title

Residence Address (Number and Street)

City, State, ZIP

Home Telephone No.

Social Security Number

Driverʼs License No./Mich. Personal Identification No.

Date of Birth

B. NAME (Last, First, Middle) (Jr./Sr., III, etc.)

Title

Residence Address (Number and Street)

City, State, ZIP

Home Telephone No.

Social Security Number

Driverʼs License No./Mich. Personal Identification No.

Date of Birth

C. NAME (Last, First, Middle) (Jr./Sr., III, etc.)

Title

Residence Address (Number and Street)

City, State, ZIP

Home Telephone No.

Social Security Number

Driverʼs License No./Mich. Personal Identification No.

Date of Birth

6. BUSINESS, TRADE, ASSUMED NAME OR DBA (if used)

7. LEGAL ADDRESS OF BUSINESS (Where all legal contact by INCOME TAX DIVISION should be made.)

Number and Street

Business Telephone No.

City, State, ZIP

County

8. MAILING ADDRESS (Where INCOME TAX DIVISION will send all tax forms, if different from 7.)

Number and Street, P.O. Box, City, State, ZIP

9. ACTUAL LOCATION OF BUSINESS (if different from 7.)

Number and Street, City, State, ZIP

Signature of Responsible Person

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2