E589j - North Carolina Department Of Revenue Affidavit To Exempt From Sales And Use Tax

ADVERTISEMENT

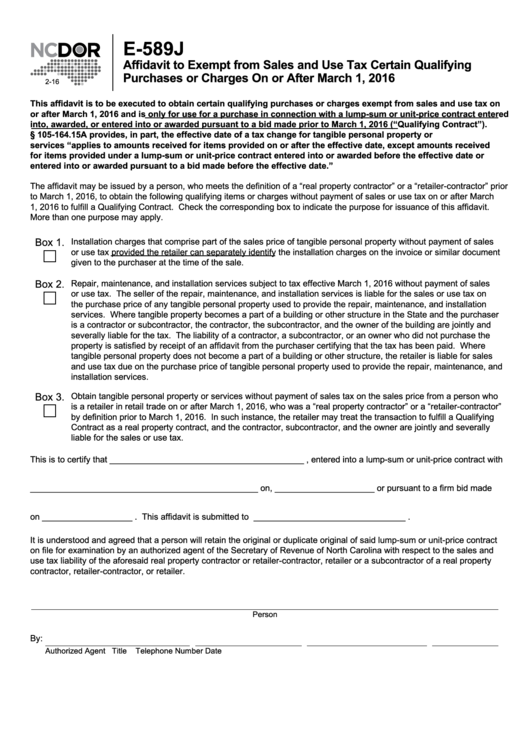

E-589J

Affidavit to Exempt from Sales and Use Tax Certain Qualifying

Purchases or Charges On or After March 1, 2016

2-16

This affidavit is to be executed to obtain certain qualifying purchases or charges exempt from sales and use tax on

or after March 1, 2016 and is only for use for a purchase in connection with a lump-sum or unit-price contract entered

into, awarded, or entered into or awarded pursuant to a bid made prior to March 1, 2016 (“Qualifying Contract”).

N.C. Gen. Stat. § 105-164.15A provides, in part, the effective date of a tax change for tangible personal property or

services “applies to amounts received for items provided on or after the effective date, except amounts received

for items provided under a lump-sum or unit-price contract entered into or awarded before the effective date or

entered into or awarded pursuant to a bid made before the effective date.”

The affidavit may be issued by a person, who meets the definition of a “real property contractor” or a “retailer-contractor” prior

to March 1, 2016, to obtain the following qualifying items or charges without payment of sales or use tax on or after March

1, 2016 to fulfill a Qualifying Contract. Check the corresponding box to indicate the purpose for issuance of this affidavit.

More than one purpose may apply.

Box 1.

Installation charges that comprise part of the sales price of tangible personal property without payment of sales

or use tax provided the retailer can separately identify the installation charges on the invoice or similar document

given to the purchaser at the time of the sale.

Box 2.

Repair, maintenance, and installation services subject to tax effective March 1, 2016 without payment of sales

or use tax. The seller of the repair, maintenance, and installation services is liable for the sales or use tax on

the purchase price of any tangible personal property used to provide the repair, maintenance, and installation

services. Where tangible property becomes a part of a building or other structure in the State and the purchaser

is a contractor or subcontractor, the contractor, the subcontractor, and the owner of the building are jointly and

severally liable for the tax. The liability of a contractor, a subcontractor, or an owner who did not purchase the

property is satisfied by receipt of an affidavit from the purchaser certifying that the tax has been paid. Where

tangible personal property does not become a part of a building or other structure, the retailer is liable for sales

and use tax due on the purchase price of tangible personal property used to provide the repair, maintenance, and

installation services.

Box 3.

Obtain tangible personal property or services without payment of sales tax on the sales price from a person who

is a retailer in retail trade on or after March 1, 2016, who was a “real property contractor” or a “retailer-contractor”

by definition prior to March 1, 2016. In such instance, the retailer may treat the transaction to fulfill a Qualifying

Contract as a real property contract, and the contractor, subcontractor, and the owner are jointly and severally

liable for the sales or use tax.

This is to certify that _________________________________________ , entered into a lump-sum or unit-price contract with

________________________________________________ on, _____________________ or pursuant to a firm bid made

on ___________________ . This affidavit is submitted to ________________________________ .

It is understood and agreed that a person will retain the original or duplicate original of said lump-sum or unit-price contract

on file for examination by an authorized agent of the Secretary of Revenue of North Carolina with respect to the sales and

use tax liability of the aforesaid real property contractor or retailer-contractor, retailer or a subcontractor of a real property

contractor, retailer-contractor, or retailer.

Person

By:

Authorized Agent

Title

Telephone Number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2