Manufactured Home Special Waiver And Commercial Move Affidavit Page 2

ADVERTISEMENT

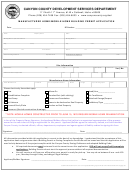

Manufactured Home Special Waiver and Commercial Move Affidavit

Instructions

The Department of Public Safety shall issue a permit to transport or move a manufactured home used for

commercial purposes during the second (2nd) through the sixth (6th) day of the first month of the following

calendar year if the applicant can provide a special waiver and a commercial move affidavit authorized pursuant

to Section 2813 of Title 68 of the Oklahoma Statutes. As used in this paragraph, “manufactured home used

for commercial purposes” means a manufactured home owned by any lawfully recognized business entity the

primary purpose of which is to provide temporary housing for the employees or contractors of the business entity.

The county assessor shall issue a special waiver and a commercial move affidavit for the second (2nd) through

the sixth (6th) day of the first month of the following year to allow a manufactured home which is used for

commercial purposes to be moved during the first five (5) days in January without a Form 936 or a tax decal. All

registration fees, excise taxes or ad valorem taxes due on the manufactured home shall be required to be paid

within thirty (30) days of the issuance of the special waiver and commercial move affidavit. A business entity

applying for a special waiver and a commercial move affidavit pursuant to this paragraph shall provide the county

assessor with the information required by subsection B of Section 14-103D of Title 47 of the Oklahoma Statutes.

No individual county assessor shall issue any business entity more than ten (10) special waivers and move

affidavits in a calendar year. [See: 68 O.S. Section 2813(B)(2)]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2