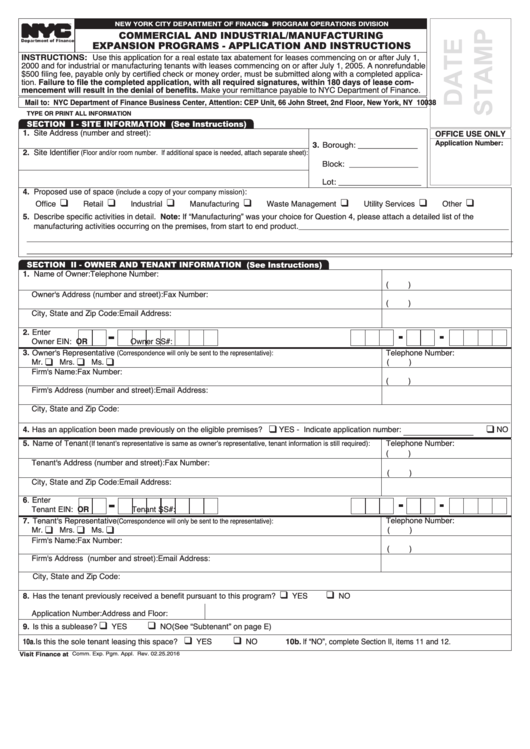

Commercial And Industrial/manufacturing Expansion Programs - Application And Instructions - New York City Department Of Finance

ADVERTISEMENT

NEW YORK CITY DEPARTMENT OF FINANCE

PROGRAM OPERATIONS DIVISION

COMMERCIAL AND INDUSTRIAL/MANUFACTURING

EXPANSION PROGRAMS - APPLICATION AND INSTRUCTIONS

INSTRUCTIONS: Use this application for a real estate tax abatement for leases commencing on or after July 1,

2000 and for industrial or manufacturing tenants with leases commencing on or after July 1, 2005. A nonrefundable

$500 filing fee, payable only by certified check or money order, must be submitted along with a completed applica-

tion. Failure to file the completed application, with all required signatures, within 180 days of lease com-

mencement will result in the denial of benefits. Make your remittance payable to NYC Department of Finance.

Mail to: NYC Department of Finance Business Center, Attention: CEP Unit, 66 John Street, 2nd Floor, New York, NY 10038

TYPE OR PRINT ALL INFORMATION

SECTION I - SITE INFORMATION (See Instructions)

1. Site Address (number and street):

OFFICE USE ONLY

3. Borough: _____________

Application Number:

2. Site Identifier

(Floor and/or room number. If additional space is needed, attach separate sheet):

Block: _______________

Lot: __________________

4. Proposed use of space

:

(include a copy of your company mission)

Office

Retail

Industrial

Manufacturing

Waste Management

Utility Services

Other

q

q

q

q

q

q

q

5. Describe specific activities in detail. Note: If “Manufacturing” was your choice for Question 4, please attach a detailed list of the

manufacturing activities occurring on the premises, from start to end product. ________________________________________________

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

SECTION II - OWNER AND TENANT INFORMATION (See Instructions)

1. Name of Owner:

Telephone Number:

(

)

Owner's Address (number and street):

Fax Number:

(

)

City, State and Zip Code:

Email Address:

2. Enter

OR

Owner EIN:

Owner SS#:

3. Owner's Representative

Telephone Number:

(Correspondence will only be sent to the representative):

Mr.

Mrs.

Ms.

(

)

q

q

q

Firm's Name:

Fax Number:

(

)

Firm's Address (number and street):

Email Address:

City, State and Zip Code:

4. Has an application been made previously on the eligible premises?

YES - Indicate application number: ________________

NO

q

q

5. Name of Tenant

Telephone Number:

(If tenant’s representative is same as owner’s representative, tenant information is still required):

(

)

Tenant's Address (number and street):

Fax Number:

(

)

City, State and Zip Code:

Email Address:

6. Enter

OR

Tenant EIN:

Tenant SS#:

7. Tenant's Representative

Telephone Number:

(Correspondence will only be sent to the representative):

Mr.

Mrs.

Ms.

(

)

q

q

q

Firm's Name:

Fax Number:

(

)

Firm's Address (number and street):

Email Address:

City, State and Zip Code:

8. Has the tenant previously received a benefit pursuant to this program?

YES

NO

q

q

Application Number:

Address and Floor:

9. Is this a sublease?

YES

NO (See “Subtenant” on page E)

q

q

10a. Is this the sole tenant leasing this space?

10b. If “NO”, complete Section II, items 11 and 12.

YES

NO

q

q

Visit Finance at nyc.gov/finance

Comm. Exp. Pgm. Appl. Rev. 02.25.2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10