Prepared Food Beverage Tax Filing Form - City Of Hopewell Virginia

ADVERTISEMENT

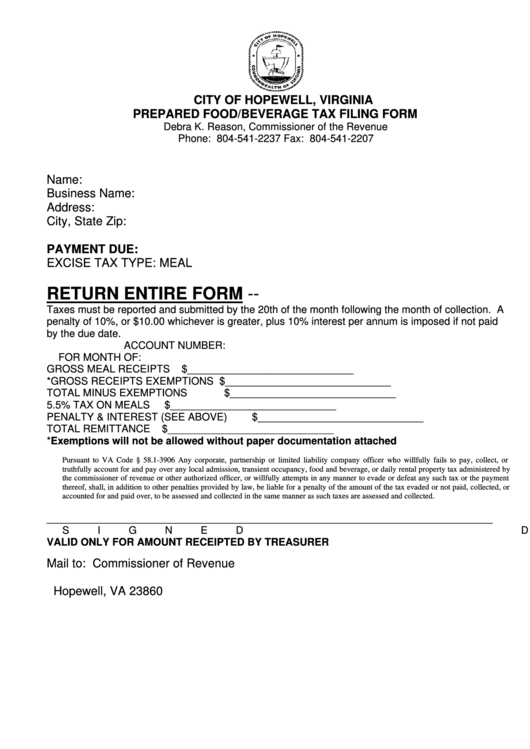

CITY OF HOPEWELL, VIRGINIA

PREPARED FOOD/BEVERAGE TAX FILING FORM

Debra K. Reason, Commissioner of the Revenue

Phone: 804-541-2237 Fax: 804-541-2207

Name:

Business Name:

Address:

City, State Zip:

PAYMENT DUE:

EXCISE TAX TYPE: MEAL

RETURN ENTIRE FORM --

Taxes must be reported and submitted by the 20th of the month following the month of collection. A

penalty of 10%, or $10.00 whichever is greater, plus 10% interest per annum is imposed if not paid

by the due date.

ACCOUNT NUMBER:

FOR MONTH OF:

GROSS MEAL RECEIPTS

$_____________________________

*GROSS RECEIPTS EXEMPTIONS

$_____________________________

TOTAL MINUS EXEMPTIONS

$_____________________________

5.5% TAX ON MEALS

$_____________________________

PENALTY & INTEREST (SEE ABOVE)

$_____________________________

TOTAL REMITTANCE

$_____________________________

*Exemptions will not be allowed without paper documentation attached

Pursuant to VA Code § 58.1-3906 Any corporate, partnership or limited liability company officer who willfully fails to pay, collect, or

truthfully account for and pay over any local admission, transient occupancy, food and beverage, or daily rental property tax administered by

the commissioner of revenue or other authorized officer, or willfully attempts in any manner to evade or defeat any such tax or the payment

thereof, shall, in addition to other penalties provided by law, be liable for a penalty of the amount of the tax evaded or not paid, collected, or

accounted for and paid over, to be assessed and collected in the same manner as such taxes are assessed and collected.

______________________________________________________________________________

SIGNED

DATE

VALID ONLY FOR AMOUNT RECEIPTED BY TREASURER

Mail to: Commissioner of Revenue

P.O. Box 1604

Hopewell, VA 23860

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2