Form R -Ez Income Tax Return

ADVERTISEMENT

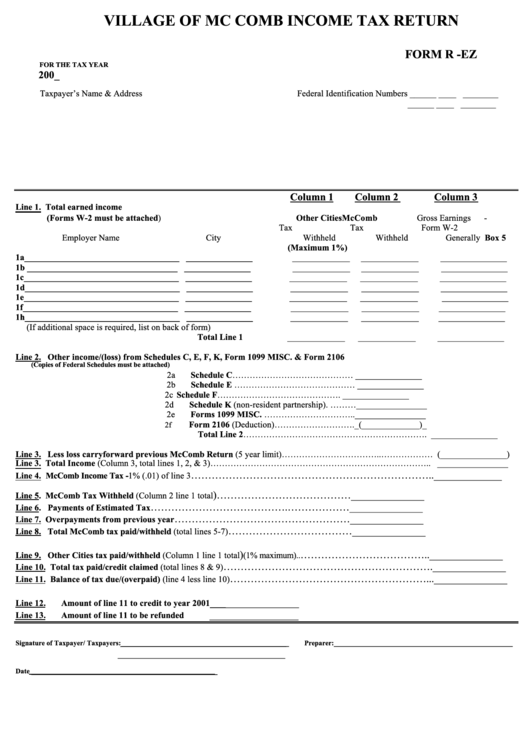

VILLAGE OF MC COMB INCOME TAX RETURN

FORM R -EZ

FOR THE TAX YEAR

200_

Taxpayer’s Name & Address

Federal Identification Numbers ______ ____ ________

______ ____ ________

Column 1

Column 2

Column 3

Line 1. Total earned income

(Forms W-2 must be attached)

Other Cities

McComb

Gross Earnings

-

Tax

Tax

Form W-2

Employer Name

City

Withheld

Withheld

Generally Box 5

(Maximum 1%)

1a___________________________________ _______________

_____________

_____________

_______________

1b __________________________________ _______________

_____________

_____________

_______________

1c___________________________________ _______________

_____________

_____________

_______________

1d___________________________________ _______________

_____________

_____________

_______________

1e___________________________________ _______________

_____________

_____________

_______________

1f___________________________________ _______________

_____________

_____________

_______________

1h___________________________________ _______________

_____________

_____________

_______________

(If additional space is required, list on back of form)

Total Line 1

_____________

_____________

_______________

Line 2. Other income/(loss) from Schedules C, E, F, K, Form 1099 MISC. & Form 2106

(Copies of Federal Schedules must be attached)

2a

Schedule C…………………………………… _______________

2b

Schedule E …………………………………… _______________

2c

Schedule F……………………………………. _______________

2d

Schedule K (non-resident partnership). ………________________

2e

Forms 1099 MISC. …………………………..________________

Form 2106 (Deduction)………………………._(_____________)_

2f

Total Line 2………………………………………………………. _______________

Line 3. Less loss carryforward previous McComb Return (5 year limit)……………………………..……………… (_______________)

Line 3. Total Income (Column 3, total lines 1, 2, & 3)………………………………………………………………….. ________________

…………………………………………………………….._____________

Line 4. McComb Income Tax -1% (.01) of line 3

)…………………………………______________

Line 5. McComb Tax Withheld (Column 2 line 1 total

………………………………….………………______________

Line 6. Payments of Estimated Tax

……………………………………………______________

Line 7. Overpayments from previous year

………………………………______________

Line 8. Total McComb tax paid/withheld (total lines 5-7)

)

………………………………..______________

Line 9. Other Cities tax paid/withheld (Column 1 line 1 total

(1% maximum)..

…………………………………………………….______________

Line 10. Total tax paid/credit claimed (total lines 8 & 9)

…………………………………………………...______________

Line 11. Balance of tax due/(overpaid) (line 4 less line 10)

_________________

Line 12.

Amount of line 11 to credit to year 2001

_________________

Line 13.

Amount of line 11 to be refunded

Signature of Taxpayer/ Taxpayers:_______________________________________________

Preparer:__________________________________________________

________________________________

Date ____________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1