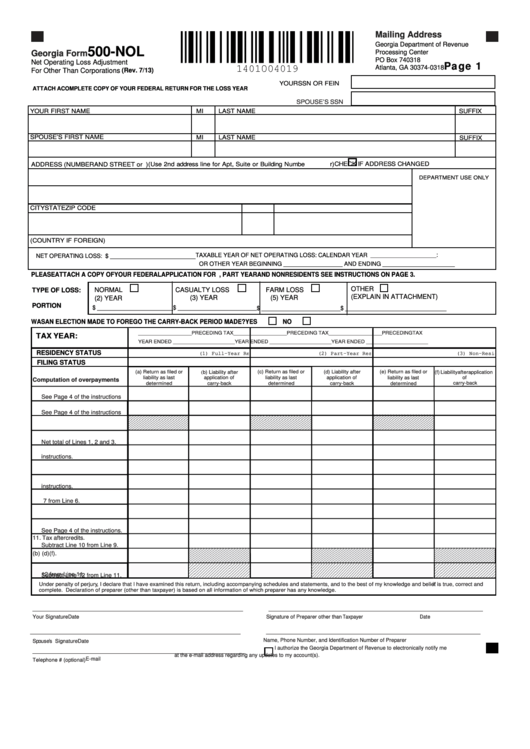

Mailing Address

Georgia Department of Revenue

500-NOL

Processing Center

Georgia Form

PO Box 740318

Page 1

Net Operating Loss Adjustment

Atlanta, GA 30374-0318

For Other Than Corporations

(Rev. 7/13)

YOUR SSN OR FEIN

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN FOR THE LOSS YEAR

SPOUSE’S SSN

YOUR FIRST NAME

MI

LAST NAME

SUFFIX

SPOUSE’S FIRST NAME

MI

LAST NAME

SUFFIX

CHECK IF ADDRESS CHANGED

ADDRESS (NUMBER AND STREET or P.O. BOX) (Use 2nd address line for Apt, Suite or Building Numbe

r)

DEPARTMENT USE ONLY

CITY

STATE

ZIP CODE

(COUNTRY IF FOREIGN)

NET OPERATING LOSS: $ __________________________ TAXABLE YEAR OF NET OPERATING LOSS: CALENDAR YEAR ____________________:

OR OTHER

YEAR BEGINNING __________________ AND ENDING ______________________

PLEASE ATTACH A COPY OF YOUR FEDERAL APPLICATION FOR N.O.L. ADJUSTMENT, PART YEAR AND NONRESIDENTS SEE INSTRUCTIONS ON PAGE 3.

OTHER

FARM LOSS

TYPE OF LOSS:

NORMAL

CASUALTY LOSS

(EXPLAIN IN ATTACHMENT)

(3) YEAR

(5) YEAR

(2) YEAR

PORTION

$ ________________________ $ _________________________ $ _________________________ $ ________________________________

WAS AN ELECTION MADE TO FOREGO THE CARRY-BACK PERIOD MADE? YES

NO

___________________ PRECEDING TAX

___________________ PRECEDING TAX

___________________ PRECEDING TAX

TAX YEAR:

YEAR ENDED ______________________

YEAR ENDED ______________________

YEAR ENDED ______________________

RESIDENCY STATUS

(2) Part-Year Resident

(1) Full-Year Resident

(3) Non-Resident

FILING STATUS

_

(c) Return as filed or

(e) Return as filed or

(a) Return as filed or

(b) Liability after

(d) Liability after

(f) Liability after application

liability as last

application of

liability as last

application of

liability as last

of

Computation of overpayments

determined

carry-back

determined

carry-back

carry-back

determined

1. Federal adjusted gross income

See Page 4 of the instructions

2. Georgia adjustments.

See Page 4 of the instructions

3. Net operating loss.

4. Georgia adjusted gross income

Net total of Lines 1, 2 and 3.

5. Deductions. See Page 4 of the

instructions.

6. Subtract Line 5 from Line 4

7. Exemptions. See Page 4 of

instructions.

8. Taxable Income. Subtract Line

7 from Line 6.

9. Income Tax.

10. Credits.

See Page 4 of the instructions.

11. Tax after credits.

Subtract Line 10 from Line 9.

12. Less Line 11 (b) (d) (f).

13. Deecrease in tax.

13. Decrease in tax.

12 from Line 11.

Subtract Line 12 from Line 11.

Under penalty of perjury , I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and

complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

______________________________________________________

_______________________________________________________

Your Signature

Date

Signature of Preparer other than Taxpayer

Date

______________________________________________________

_______________________________________________________

Name, Phone Number, and Identification Number of Preparer

Spouse’s Signature

Date

I authorize the Georgia Department of Revenue to electronically notify me

_____________________________________________________

at the e-mail address regarding any updates to my account(s).

E-mail

Telephone # (optional)

1

1 2

2 3

3 4

4