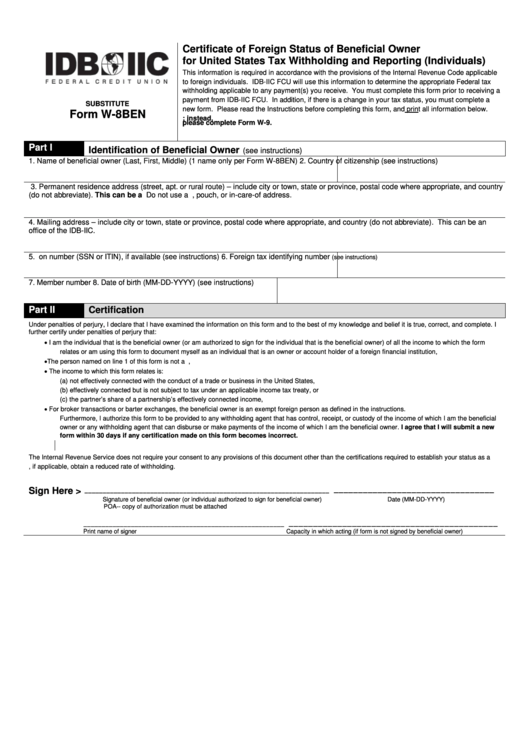

Certificate of Foreign Status of Beneficial Owner

for United States Tax Withholding and Reporting (Individuals)

This information is required in accordance with the provisions of the Internal Revenue Code applicable

to foreign individuals. IDB-IIC FCU will use this information to determine the appropriate Federal tax

withholding applicable to any payment(s) you receive. You must complete this form prior to receiving a

payment from IDB-IIC FCU. In addition, if there is a change in your tax status, you must complete a

SUBSTITUTE

new form. Please read the Instructions before completing this form, and print all information below.

Form W-8BEN

U.S. CITIZENS and LAWFUL PERMANENT RESIDENTS should not complete this form; instead,

please complete Form W-9.

Part I

Identification of Beneficial Owner

(see instructions)

1. Name of beneficial owner (Last, First, Middle) (1 name only per Form W-8BEN)

2. Country of citizenship (see instructions)

3. Permanent residence address (street, apt. or rural route) – include city or town, state or province, postal code where appropriate, and country

(do not abbreviate). This can be a U.S. address. Do not use a P.O. box, pouch, or in-care-of address.

4. Mailing address – include city or town, state or province, postal code where appropriate, and country (do not abbreviate). This can be an

office of the IDB-IIC.

5. U.S. taxpayer identification number (SSN or ITIN), if available (see instructions)

6. Foreign tax identifying number

(see instructions)

7. Member number

8. Date of birth (MM-DD-YYYY) (see instructions)

Part II

Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I

further certify under penalties of perjury that:

I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income to which the form

relates or am using this form to document myself as an individual that is an owner or account holder of a foreign financial institution,

The person named on line 1 of this form is not a U.S. person,

The income to which this form relates is:

(a)

not effectively connected with the conduct of a trade or business in the United States,

(b)

effectively connected but is not subject to tax under an applicable income tax treaty, or

(c)

the partner’s share of a partnership’s effectively connected income,

For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial

owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner. I agree that I will submit a new

form within 30 days if any certification made on this form becomes incorrect.

The Internal Revenue Service does not require your consent to any provisions of this document other than the certifications required to establish your status as a

non-U.S. person and, if applicable, obtain a reduced rate of withholding.

_________________________________

___________________________________________________________________

Sign Here >

Signature of beneficial owner (or individual authorized to sign for beneficial owner)

Date (MM-DD-YYYY)

POA-- copy of authorization must be attached

___________________________________________

_______________________________________________________

Print name of signer

Capacity in which acting (if form is not signed by beneficial owner)

1

1 2

2 3

3 4

4