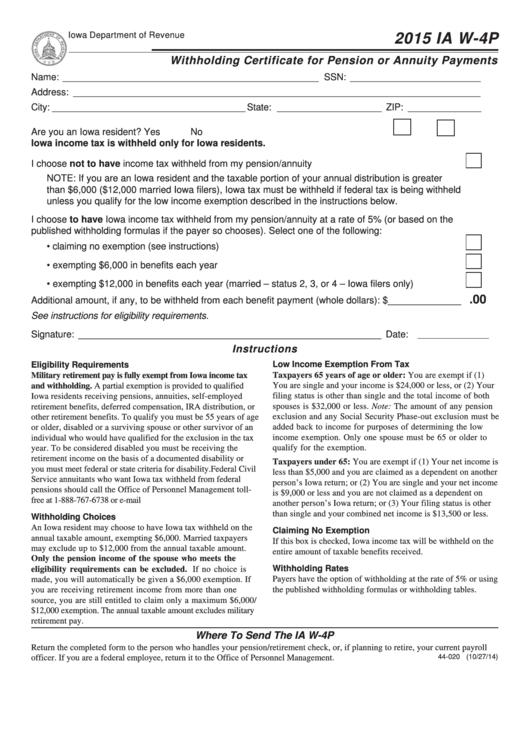

Iowa Department of Revenue

2015 IA W-4P

Withholding Certificate for Pension or Annuity Payments

Name: _________________________________________________ SSN: _________________________

Address: ______________________________________________________________________________

City: _____________________________________ State: ____________________ ZIP: ______________

Are you an Iowa resident? ............................................................................................

Yes

No

Iowa income tax is withheld only for Iowa residents.

I choose not to have income tax withheld from my pension/annuity .......................................................

NOTE: If you are an Iowa resident and the taxable portion of your annual distribution is greater

than $6,000 ($12,000 married Iowa filers), Iowa tax must be withheld if federal tax is being withheld

unless you qualify for the low income exemption described in the instructions below.

I choose to have Iowa income tax withheld from my pension/annuity at a rate of 5% (or based on the

published withholding formulas if the payer so chooses). Select one of the following:

• claiming no exemption (see instructions) ...........................................................................................

• exempting $6,000 in benefits each year ...........................................................................................

• exempting $12,000 in benefits each year (married – status 2, 3, or 4 – Iowa filers only) ................

.00

Additional amount, if any, to be withheld from each benefit payment (whole dollars): $ ______________

See instructions for eligibility requirements.

Signature: __________________________________________________________ Date:

Instructions

Low Income Exemption From Tax

Eligibility Requirements

Taxpayers 65 years of age or older: You are exempt if (1)

Military retirement pay is fully exempt from Iowa income tax

You are single and your income is $24,000 or less, or (2) Your

and withholding. A partial exemption is provided to qualified

filing status is other than single and the total income of both

Iowa residents receiving pensions, annuities, self-employed

spouses is $32,000 or less. Note: The amount of any pension

retirement benefits, deferred compensation, IRA distribution, or

exclusion and any Social Security Phase-out exclusion must be

other retirement benefits. To qualify you must be 55 years of age

added back to income for purposes of determining the low

or older, disabled or a surviving spouse or other survivor of an

income exemption. Only one spouse must be 65 or older to

individual who would have qualified for the exclusion in the tax

qualify for the exemption.

year. To be considered disabled you must be receiving the

retirement income on the basis of a documented disability or

Taxpayers under 65: You are exempt if (1) Your net income is

you must meet federal or state criteria for disability. Federal Civil

less than $5,000 and you are claimed as a dependent on another

Service annuitants who want Iowa tax withheld from federal

person’s Iowa return; or (2) You are single and your net income

pensions should call the Office of Personnel Management toll-

is $9,000 or less and you are not claimed as a dependent on

free at 1-888-767-6738 or e-mail retire@opm.gov.

another person’s Iowa return; or (3) Your filing status is other

than single and your combined net income is $13,500 or less.

Withholding Choices

An Iowa resident may choose to have Iowa tax withheld on the

Claiming No Exemption

annual taxable amount, exempting $6,000. Married taxpayers

If this box is checked, Iowa income tax will be withheld on the

may exclude up to $12,000 from the annual taxable amount.

entire amount of taxable benefits received.

Only the pension income of the spouse who meets the

Withholding Rates

eligibility requirements can be excluded. If no choice is

Payers have the option of withholding at the rate of 5% or using

made, you will automatically be given a $6,000 exemption. If

the published withholding formulas or withholding tables.

you are receiving retirement income from more than one

source, you are still entitled to claim only a maximum $6,000/

$12,000 exemption. The annual taxable amount excludes military

retirement pay.

Where To Send The IA W-4P

Return the completed form to the person who handles your pension/retirement check, or, if planning to retire, your current payroll

44-020

(10/27/14)

officer. If you are a federal employee, return it to the Office of Personnel Management.

1

1