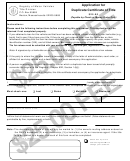

Wisconsin Manufactured Home Certificate Of Title Application Page 2

ADVERTISEMENT

How to Complete This Application

If you have questions, contact the Manufactured Home Unit, 608-264-9596; TTY 608-264-8777,

DspsSbManfHomes@wi.gov

To get a title for a manufactured home, you must complete Sections A through F as they apply.

Include the original Certificate of Title of Manufactured Home (not a copy) for a used manufactured home.

(OR) Include the original Manufacturer’s Certificate of Origin for a new Manufactured Home.

To replace a lost or damaged manufactured home title, complete Sections A - F as they apply. Note - The replacement manufactured home title

voids all previous certificates.

-

A. Owner Information

Owners name entered will be the name appearing on the new title. ““And” means all owners must sign to

transfer ownership. “Or” means only one owner must sign. For additional names, attach a separate sheet of paper.

B. Manufactured Home Information

– Enter all information about the manufactured home. Length and width of the home are

approximate.

-

C. Loan Information

If you borrowed money for this home, contact the lender for the correct information. Please show complete

mailing address. Loan filing fee is $4 for each new loan.

D. Fees

-

Title (Transfer, Original and Heir) Fee = $23.00

Wisconsin Title Transfer – This Wisconsin titled manufactured home is being transferred to another owner or a name is being added or

deleted from the existing title. Adding or deleting a spouse’s name from the title is considered a transfer of ownership. If there is a

secured party on the title document accompanying this application, an original lien release is required.

Original Wisconsin Title – The manufactured home to be registered has never been titled or was last titled in another state or

country.

Submit the Manufacturer’s Certificate of Origin (if new home) or original Certificate of Title (if used home).

Heir Transfer

If you are an heir to a Wisconsin titled manufactured home, you need to remove the name of the deceased person as the registered owner

on the title. A transfer to surviving spouse form must be included with this application.

Title Replacement Fee = $8.00

The manufactured home was previously titled in your name and it has been lost, stolen, or mutilated. Title was originally in your name.

Surviving Spouse Transfer Fee = $15.50

If you are a surviving spouse to the owner of a Wisconsin titled manufactured home, you need to remove the name of the deceased spouse

as the registered owner on the title. A transfer to surviving spouse form must be included with this application.

Surviving Domestic Partner under ch 770 Transfer Fee = $15.50

If you are a surviving spouse to the owner of a Wisconsin titled manufactured home, you need to remove the name of the deceased

domestic partner as the registered owner on the title. A transfer to surviving domestic partner form must be included with this application.

Loan Filing (Lien) Fee = $4.00 (Per Loan)

If you borrowed money for this home, contact the lender for the correct information. Please show complete mailing address.

Request For Fast Service Fee = $15.00 (Per Application)

To request immediate processing of your title, attach $15.00 fee per application. This applies to all title applications that are sent to our

office, including walk-in customers and applications sent overnight.

Salvage or Flood Damage Title = NO FEE

A Wisconsin salvage title is for a manufactured home that does not meet the definition of “junk” and is damaged by collision, flood

damage or other occurrence to the extent that the estimated or actual cost, whichever is greater or repairing the manufactured home

exceeds 70% of its fair market value. “Junked” means dismantled for parts or scrapped. It is also for a manufactured home which was

last titled in another state as a salvage home. Write “Junked” or “Salvaged” on title and mail to our office.

E. Licensed Dealer’s Statement of Sale and Warranty

– If the sale is a “Courtesy Delivery” or a “Consigned Manufactured

Home”, write this in the Dealer Number space.

- Sales Tax - The Dealer signature also serves as evidence that the appropriate sales taxes have been collected and forwarded to the Department

of Revenue. Note: The amount subject to sales tax for new homes is 65% of the full purchase price of home described in section B. No sales

tax is owed for used homes.

- Wisconsin Dept. of Revenue Seller’s Permit Number: Dealers that sell new homes are required to have a seller’s permit number issued

through the Dept. of Revenue. Dealers that sell only used homes need not have the permit number. Enter “sell only used homes” in this line.

- Out of state dealers must contact the Manufactured Home Unit for additional instructions.

F. Owners Signatures –

All owners shown in Section A must sign. If an owner is under 18, a separate completed Consent of Purchase

form must be included with this application.

Release of Information - The Wisconsin Department of Safety and Professional Services may use the personal information you provided for secondary purposes [Privacy Laws s. 15.04 (1) (m) Stats.]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2