Form 8850 - Pre-Screening Notice And Certification Request For The Work Opportunity Credit

ADVERTISEMENT

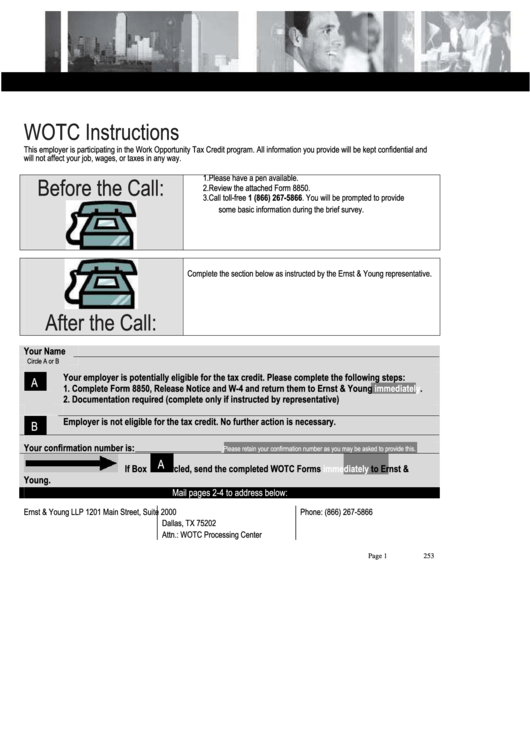

WOTC Instructions

This employer is participating in the Work Opportunity Tax Credit program. All information you provide will be kept confidential and

will not affect your job, wages, or taxes in any way.

1.

Please have a pen available.

Before the Call:

2.

Review the attached Form 8850.

3.

Call toll-free 1 (866) 267-5866. You will be prompted to provide

some basic information during the brief survey.

Complete the section below as instructed by the Ernst & Young representative.

After the Call:

Your Name

Circle A or B

Your employer is potentially eligible for the tax credit. Please complete the following steps:

A

1. Complete Form 8850, Release Notice and W-4 and return them to Ernst & Young immediately.

2. Documentation required (complete only if instructed by representative)

Employer is not eligible for the tax credit. No further action is necessary.

B

Your confirmation number is:

______________________

Please retain your confirmation number as you may be asked to provide this.

A

If Box

is circled, send the completed WOTC Forms

immediately

to Ernst &

Young.

Mail pages 2-4 to address below:

Ernst & Young LLP

1201 Main Street, Suite 2000

Phone: (866) 267-5866

Dallas, TX 75202

Attn.: WOTC Processing Center

Page 1

253

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4