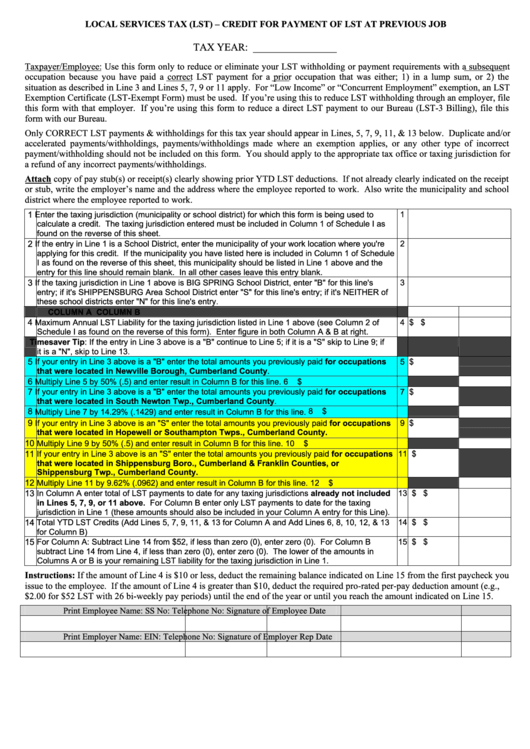

LOCAL SERVICES TAX (LST) – CREDIT FOR PAYMENT OF LST AT PREVIOUS JOB

TAX YEAR: ________________

Taxpayer/Employee: Use this form only to reduce or eliminate your LST withholding or payment requirements with a subsequent

occupation because you have paid a correct LST payment for a prior occupation that was either; 1) in a lump sum, or 2) the

situation as described in Line 3 and Lines 5, 7, 9 or 11 apply. For “Low Income” or “Concurrent Employment” exemption, an LST

Exemption Certificate (LST-Exempt Form) must be used. If you’re using this to reduce LST withholding through an employer, file

this form with that employer. If you’re using this form to reduce a direct LST payment to our Bureau (LST-3 Billing), file this

form with our Bureau.

Only CORRECT LST payments & withholdings for this tax year should appear in Lines, 5, 7, 9, 11, & 13 below. Duplicate and/or

accelerated payments/withholdings, payments/withholdings made where an exemption applies, or any other type of incorrect

payment/withholding should not be included on this form. You should apply to the appropriate tax office or taxing jurisdiction for

a refund of any incorrect payments/withholdings.

Attach copy of pay stub(s) or receipt(s) clearly showing prior YTD LST deductions. If not already clearly indicated on the receipt

or stub, write the employer’s name and the address where the employee reported to work. Also write the municipality and school

district where the employee reported to work.

1

Enter the taxing jurisdiction (municipality or school district) for which this form is being used to

1

calculate a credit. The taxing jurisdiction entered must be included in Column 1 of Schedule I as

found on the reverse of this sheet.

2

If the entry in Line 1 is a School District, enter the municipality of your work location where you're

2

applying for this credit. If the municipality you have listed here is included in Column 1 of Schedule

I as found on the reverse of this sheet, this municipality should be listed in Line 1 above and the

entry for this line should remain blank. In all other cases leave this entry blank.

3

If the taxing jurisdiction in Line 1 above is BIG SPRING School District, enter "B" for this line's

3

entry; if it's SHIPPENSBURG Area School District enter "S" for this line's entry; if it's NEITHER of

these school districts enter "N" for this line's entry.

COLUMN A

COLUMN B

4

4 $

$

Maximum Annual LST Liability for the taxing jurisdiction listed in Line 1 above (see Column 2 of

Schedule I as found on the reverse of this form). Enter figure in both Column A & B at right.

Timesaver Tip: If the entry in Line 3 above is a "B" continue to Line 5; if it is a "S" skip to Line 9; if

it is a "N", skip to Line 13.

5

If your entry in Line 3 above is a "B" enter the total amounts you previously paid for occupations

5 $

that were located in Newville Borough, Cumberland County.

6

Multiply Line 5 by 50% (.5) and enter result in Column B for this line.

6

$

7

If your entry in Line 3 above is a "B" enter the total amounts you previously paid for occupations

7 $

that were located in South Newton Twp., Cumberland County.

8

8

$

Multiply Line 7 by 14.29% (.1429) and enter result in Column B for this line.

9

If your entry in Line 3 above is an "S" enter the total amounts you previously paid for occupations

9 $

that were located in Hopewell or Southampton Twps., Cumberland County.

10

10

$

Multiply Line 9 by 50% (.5) and enter result in Column B for this line.

11

If your entry in Line 3 above is an "S" enter the total amounts you previously paid for occupations

11 $

that were located in Shippensburg Boro., Cumberland & Franklin Counties, or

Shippensburg Twp., Cumberland County.

12

Multiply Line 11 by 9.62% (.0962) and enter result in Column B for this line.

12

$

13

In Column A enter total of LST payments to date for any taxing jurisdictions already not included

13 $

$

in Lines 5, 7, 9, or 11 above. For Column B enter only LST payments to date for the taxing

jurisdiction in Line 1 (these amounts should also be included in your Column A entry for this Line).

14

Total YTD LST Credits (Add Lines 5, 7, 9, 11, & 13 for Column A and Add Lines 6, 8, 10, 12, & 13

14 $

$

for Column B)

15

For Column A: Subtract Line 14 from $52, if less than zero (0), enter zero (0). For Column B

15 $

$

subtract Line 14 from Line 4, if less than zero (0), enter zero (0). The lower of the amounts in

Columns A or B is your remaining LST liability for the taxing jurisdiction in Line 1.

Instructions: If the amount of Line 4 is $10 or less, deduct the remaining balance indicated on Line 15 from the first paycheck you

issue to the employee. If the amount of Line 4 is greater than $10, deduct the required pro-rated per-pay deduction amount (e.g.,

$2.00 for $52 LST with 26 bi-weekly pay periods) until the end of the year or until you reach the amount indicated on Line 15.

Print Employee Name:

SS No:

Telephone No:

Signature of Employee

Date

Print Employer Name:

EIN:

Telephone No:

Signature of Employer Rep

Date

1

1 2

2