*GRET1012*

GRET1012

License #

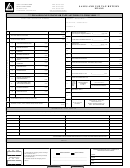

City of Glendale Privilege (Sales) Tax Return – page 2

Schedule A - Details of deductions: Enter the deductions included in the gross used in computing your City Privilege (Sales) Tax.

The line numbers at the top of each column correspond with the line numbers on the front page (no Line 1 is listed).

Please note: Deductions marked as ***NOT AVAILABLE*** are not allowable to the specified Business Class and cannot be used.

Line 2 - Business Class Code

Line 3 - Business Class Code

Line 4 - Business Class Code

SCHEDULE A

Deduction Description

Privilege (Sales) Tax Collected (if

64

included in gross)

Interstate Telecommunications

66

Sales for Resale or for Lease,

54

Leases for Re-lease

Retail Service Labor

63

Discounts Allowed

52

Freight Out/Delivery Charges

74

(when invoiced separately)

Sales & Leases to Qualifying

65

Health Organizations

Sales to U.S. Govt.

56

by retailer 50% deductible

National Advertising

69

Out-of-state Sales & Leases

55

Bad Debt on which Tax was Paid

81

35% Construction Contracting

70

Subcontracting for Prime

71

Contractor/Speculative Builders

Out-of-City Construction

62

Contracting

Refund and Returns (if included in

53

Gross)

Sales of Motor Vehicle Gasoline

59

and Use Fuel

Sales & Leases of Income

73

Producing Capital Equipment

Medical Devices, Prosthetics &

58

Prescription Drugs

Lottery Ticket Sales

68

Misc. Deductions- Please Explain below

75

0.00

0.00

0.00

TOTAL DEDUCTIONS (Copy to Front)

SCHEDULE B Credit Details (please verify credit before claiming)

SCHEDULE C

,

Line 2

Excess Tax Collected

B

Account Credit

,

,

.

Excess Tax by business class code

C

Line 3

Speculative Builder Credit

B

for City Taxes Paid by the Contractor

,

,

+

.

+

Line 4

Total Schedule B

Total Schedule C

0.00

,

,

(copy total to front, line 10)

.

0.00

(copy total to front, line 6)

POSTMARKS ARE NOT ACCEPTED AS EVIDENCE OF TIMELY FILING.

FOR ASSISTANCE, CALL: City of Glendale (623) 930-3190 (Press 1), TTY (623) 930-2197, Fax (623) 930-2186,

or visit our website

Print version 04/2010-1

1

1 2

2 3

3 4

4