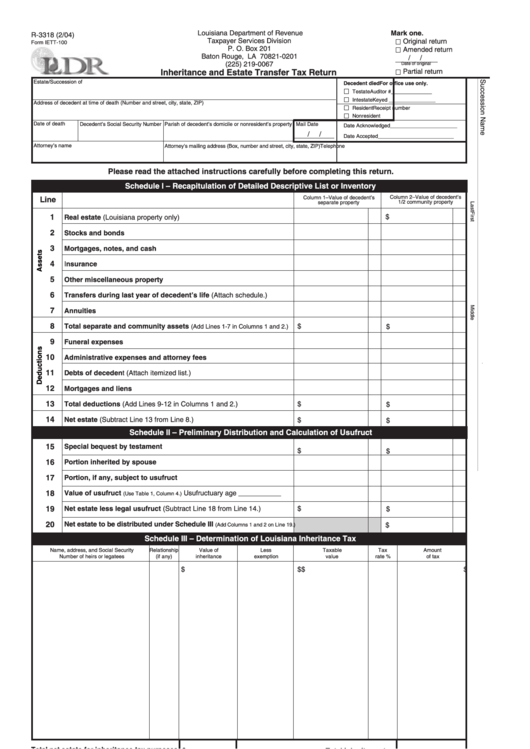

Louisiana Department of Revenue

Mark one.

R-3318 (2/04)

Taxpayer Services Division

Original return

Form IETT-100

P. O. Box 201

Amended return

Baton Rouge, LA 70821-0201

/

/

(225) 219-0067

Date of

originalaaa

Partial return

Inheritance and Estate Transfer Tax Return

Estate/Succession of

Decedent died

For office use only.

Testate

Auditor # ______________

Intestate

Keyed ________________

Address of decedent at time of death (Number and street, city, state, ZIP)

Resident

Receipt number

Nonresident

Date of death

Decedent’s Social Security Number

Parish of decedent’s domicile or nonresident’s property

Mail Date

Date Acknowledged _______________________

/

/

Date Accepted __________________________

Attorney’s name

Attorney's mailing address (Box, number and street, city, state, ZIP)

Telephone

Please read the attached instructions carefully before completing this return.

Schedule I – Recapitulation of Detailed Descriptive List or Inventory

Column 1–Value of decedent’s

Column 2–Value of decedent’s

Line

1/2 community property

separate property

1

$

Real estate (Louisiana property only)

2

Stocks and bonds

3

Mortgages, notes, and cash

4

Insurance

5

Other miscellaneous property

6

Transfers during last year of decedent’s life (Attach schedule.)

7

Annuities

8

$

Total separate and community assets

$

(Add Lines 1-7 in Columns 1 and 2.)

9

Funeral expenses

10

Administrative expenses and attorney fees

11

Debts of decedent (Attach itemized list.)

12

Mortgages and liens

13

Total deductions (Add Lines 9-12 in Columns 1 and 2.)

$

$

14

Net estate (Subtract Line 13 from Line 8.)

$

$

Schedule II – Preliminary Distribution and Calculation of Usufruct

15

Special bequest by testament

$

$

16

Portion inherited by spouse

17

Portion, if any, subject to usufruct

18

Value of usufruct

Usufructuary age ___________

(Use Table 1, Column 4.)

19

Net estate less legal usufruct (Subtract Line 18 from Line 14.)

$

$

20

Net estate to be distributed under Schedule III

(Add Columns 1 and 2 on Line 19.)

$

Schedule III – Determination of Louisiana Inheritance Tax

Name, address, and Social Security

Relationship

Value of

Less

Taxable

Tax

Amount

Number of heirs or legatees

(if any)

inheritance

exemption

value

rate %

of tax

$

$

$

$

Total net estate for inheritance tax purposes

$

Total inheritance tax

$

(Same as Line 20, Schedule II)

(Forward to Line 4, Schedule IV.)

Total due or refund due

$

(From Line 6, Schedule V)

1401

1

1 2

2