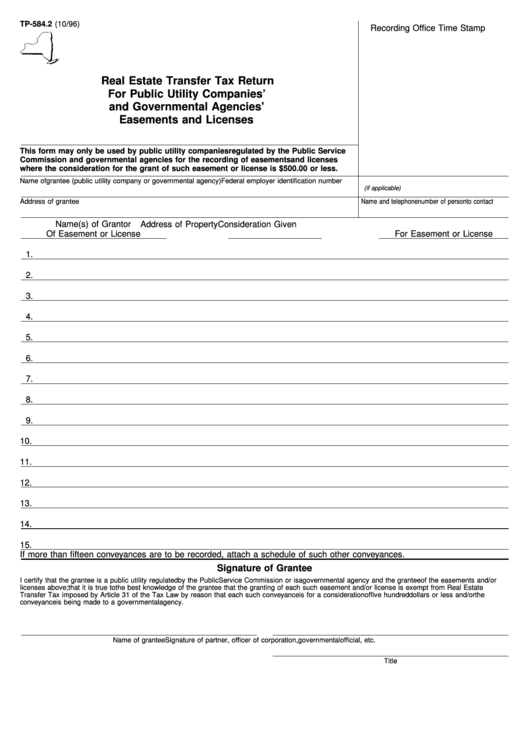

Form Tp-584.2 - Real Estate Transfer Tax Return For Public Utility Companies' And Governmental Agencies' Easements And Licenses

ADVERTISEMENT

TP-584.2 (10/96)

Recording Office Time Stamp

Real Estate Transfer Tax Return

For Public Utility Companies’

and Governmental Agencies’

Easements and Licenses

This form may only be used by public utility companies regulated by the Public Service

Commission and governmental agencies for the recording of easements and licenses

where the consideration for the grant of such easement or license is $500.00 or less.

Name of grantee (public utility company or governmental agency)

Federal employer identification number

(if applicable)

Address of grantee

Name and telephone number of person to contact

Name(s) of Grantor

Address of Property

Consideration Given

Of Easement or License

For Easement or License

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

If more than fifteen conveyances are to be recorded, attach a schedule of such other conveyances.

Signature of Grantee

I certify that the grantee is a public utility regulated by the Public Service Commission or is a governmental agency and the grantee of the easements and/or

licenses above; that it is true to the best knowledge of the grantee that the granting of each such easement and/or license is exempt from Real Estate

Transfer Tax imposed by Article 31 of the Tax Law by reason that each such conveyance is for a consideration of five hundred dollars or less and/or the

conveyance is being made to a governmental agency.

Name of grantee

Signature of partner, officer of corporation, governmental official, etc.

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1