Determination Of Alien Tax Status & Request For Itin - Substitute Form W-8 - Research Foundation Of The City University Of New York Page 2

ADVERTISEMENT

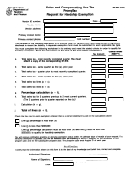

Test 2:

Complete the spaces below, indicating the number of days present in the United States during

the years listed. Do not count any days during your first five years in the United States for which

SUBSTANTIAL

you were an F or J visa category nonimmigrant student. You will meet the requirements of the

test if you have been in the United States for a total of 183 days (without counting any days

PRESENCE

TEST

present as an F or J category nonimmigrant during your first five years in the United States).

Enter

Date Entered

Date

No. of Days in

Computation

Year

United States

Departed

United States

for test

______

__________

_______

_________

x 1

=

__________

Current Year

______

__________

_______

_________

x 1/3 =

__________

Last Year

______

__________

_______

_________

x 1/6 =

__________

Two Years ago

If total is less than 183: You are a NONRESIDENT ALIEN for tax purposes. Skip Test 3.

Check appropriate line in "test results" section below.

Total:_______________

If total is equal to or more than 183: Complete test 3 below.

Test 3:

Check applicable line:

EXCEPTIONS

Have you been or do you plan to be in the United States for less than 183 days this calendar year

TO THE

AND do you pay taxes in your country of residence AND do you have a closer connection to that

SUBSTANTIAL

country than the United States (by virtue of family ties, friends, business/banking relationships, etc.)?

PRESENCE

TEST

_____ YES. You are a NONRESIDENT ALIEN for tax purposes. Check the line in "test results" below.

_____ NO. You are a RESIDENT ALIEN for tax purposes. Check the line in "test results" below.

TEST

Mark the appropriate Federal Tax Withholding Status. (you must check one of the lines!)

RESULTS

For tax purposes I am a:

YOUR

_____ RESIDENT ALIEN

RESIDENCE

STATUS

_____ NONRESIDENT ALIEN

C. ADDRESS INFORMATION (must be completed)

Mailing Address and in the United States:

Mailing Address in Your Country of Residence:

City

State

Zip Code

City

Country

Postal Code

US telephone number

Work (if working)

E-Mail address:

@

D. CERTIFICATE OF INFORMATION PROVIDED ON FORM (must be completed)

The Internal Revenue Service does not require your consent to any provisions of this document other than the certifications required

to establish your status as a non-U.S. person and, if applicable, obtain a reduced rate of withholding.

I Certify that to the best of my knowledge and belief, all of the information that I have provided is true and correct.

Signature: _____________________________________________________

Date: _____________________________

Attach this form to your payment request or email to Konstantin Perepelitsa ( )

Form RF-702 rev. 12/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2