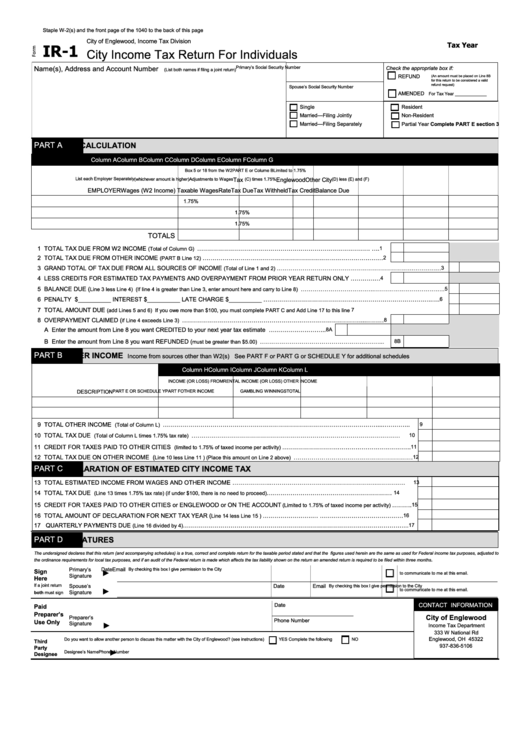

Staple W-2(s) and the front page of the 1040 to the back of this page

City of Englewood, Income Tax Division

Tax Year

IR-1

City Income Tax Return For Individuals

Name(s), Address and Account Number

Primary’s Social Security Number

Check the appropriate box if:

(List both names if filing a joint return)

REFUND

(An amount must be placed on Line 8B

for this return to be considered a valid

refund request)

Spouse’s Social Security Number

AMENDED

For Tax Year _____________

Single

Resident

Married—Filing Jointly

Non-Resident

Married—Filing Separately

Partial Year Complete PART E section 3

PART A

TAX CALCULATION

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Box 5 or 18 from the W2

PART E or Colume B

Limited to 1.75%

List each Employer Separately

(whichever amount is higher)

Adjustments to Wages

Tax

(C) times 1.75%

Englewood

Other City

(D) less (E) and (F)

EMPLOYER

Wages (W2 Income)

Taxable Wages

Rate

Tax Due

Tax Withheld

Tax Credit

Balance Due

1.75%

1.75%

1.75%

TOTALS

1 TOTAL TAX DUE FROM W2 INCOME

……………………………………………………………………………....….

1

(Total of Column G)

2 TOTAL TAX DUE FROM OTHER INCOME

…………………………………………………………………………….…

2

(PART B Line 12)

3 GRAND TOTAL OF TAX DUE FROM ALL SOURCES OF INCOME

…………………………………………………………..……………

3

(Total of Line 1 and 2)

4 LESS CREDITS FOR ESTIMATED TAX PAYMENTS AND OVERPAYMENT FROM PRIOR YEAR RETURN ONLY ……………

4

5 BALANCE DUE (

……………………………….………………….…………..

5

Line 3 less Line 4) (If line 4 is greater than Line 3, enter amount here and carry to Line 8)

6 PENALTY $__________ INTEREST $__________ LATE CHARGE $__________ ………………………………………………………………………….….

6

7 TOTAL AMOUNT DUE

7

(add Lines 5 and 6) If you owe more than $100, you must complete PART C and Add Line 17 to this line

8 OVERPAYMENT CLAIMED (

………………………………………………………………………………...………

8

if Line 4 exceeds Line 3)

A Enter the amount from Line 8 you want CREDITED to your next year tax estimate ………………………..

8A

B Enter the amount from Line 8 you want REFUNDED (

……………………………………………………...

8B

must be greater than $5.00)

PART B

OTHER INCOME

Income from sources other than W2(s) See PART F or PART G or SCHEDULE Y for additional schedules

Column H

Column I

Column J

Column K

Column L

INCOME (OR LOSS) FROM

RENTAL INCOME (OR LOSS)

OTHER INCOME

DESCRIPTION

PART E OR SCHEDULE Y

PART F

OTHER INCOME

GAMBLING WINNINGS

TOTAL

9 TOTAL OTHER INCOME

………………………………………………………………………………………………...…………..

9

(Total of Column L)

10 TOTAL TAX DUE

……………………………………………………………………………………………......

10

(Total of Column L times 1.75% tax rate)

11 CREDIT FOR TAXES PAID TO OTHER CITIES

……………………….……………………………….

11

(limited to 1.75% of taxed income per activity)

12 TOTAL TAX DUE ON OTHER INCOME (

……………………………………………………

12

Line 10 less Line 11 ) (Place this amount on Line 2 above)

PART C

DECLARATION OF ESTIMATED CITY INCOME TAX

13 TOTAL ESTIMATED INCOME FROM WAGES AND OTHER INCOME ………………..……………………………………………...…………..

13

14 TOTAL TAX DUE

………………………………………………………......

14

(Line 13 times 1.75% tax rate) (if under $100, there is no need to proceed)

15 CREDIT FOR TAXES PAID TO OTHER CITIES or ENGLEWOOD or ON THE ACCOUNT

……….

15

(Limited to 1.75% of taxed income per activity)

16 TOTAL AMOUNT OF DECLARATION FOR NEXT TAX YEAR (

…………………….…....……………………………………

16

Line 14 less Line 15 )

17 QUARTERLY PAYMENTS DUE

…………………………………………………………………………………………………...

17

(Line 16 divided by 4)

PART D

SIGNATURES

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal income tax purposes, adjusted to

.

the ordinance requirements for local tax purposes, and if an audit of the Federal return is made which affects the tax liability shown on the return an amended return is required to be filed within three months

Primary’s

Date

Email

By checking this box I give permission to the City

Sign

to communicate to me at this email.

Signature

Here

If a joint return

Spouse’s

Date

Email

By checking this box I give permission to the City

to communicate to me at this email.

Signature

both must sign

CONTACT INFORMATION

Date

Paid

Preparer’s

City of Englewood

Preparer’s

Phone Number

Use Only

Signature

Income Tax Department

333 W National Rd

Englewood, OH 45322

Do you want to allow another person to discuss this matter with the City of Englewood? (see instructions)

YES Complete the following

NO

Third

937-836-5106

Party

Designee’s Name

Phone Number

tax@englewood.oh.us

Designee

1

1 2

2 3

3