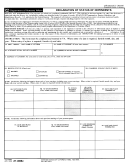

Exemption

– Declaration and Undertaking to be made by the beneficial owner of a dividend

B

This part is to be completed by the person entitled to the benefit of the dividend attaching to a security(ies)

• This form is to be completed by the beneficial owner (of dividends, including dividends

in specie

) in order for the exemptions from dividends tax

referred to in section 64F read with sections 64FA(2), 64G(2) or 64H(2)(a) of the Income Tax Act, 1962 (Act No 58 of 1962) (the Act) to apply.

• In order to qualify for an exemption this declaration and written undertaking should be submitted to the regulated intermediary, Computershare -

failure to do so will result in the full 15% dividends tax being withheld/payable on any dividends issued.

• Non South African residents seeking to qualify for a reduced rate should not complete this section. Please complete section C.

Please indicate the reason why the beneficial owner is exempt from the dividends tax in terms of the relevant paragraph of the Income

Tax Act as follows:

Par (a) - a company which is resident in South Africa

Par (j) - a person who is not a resident and the dividend is a

dividend contemplated in paragraph (b) of the definition of

“dividend” in section 64D (i.e. a dividend paid by a foreign

company whose share listing is on the JSE, such as dual-listed

shares)

Par (b) - the Government, provincial government or municipality

Par (k) – a portfolio of a collective investment scheme in

(of the Republic of South Africa)

securities

Par (c) - a public benefit organisation (approved by SARS ito

Par (l) – Any person insofar as the dividend constitutes income

section 30(3) of the Act)

of that person (i.e. falls into normal tax system)

Par (d) - a trust contemplated in section 37A of the Act (mining

Par (m) – any person to the extent that the dividend was subject

rehabilitation trusts)

to STC

Par (e) - an institution, body, or board contemplated in section

Par (n) - Fidelity or indemnity fund contemplated in section

10(1)(cA) of the Act

10(1)(d)(iii)

Par (f) - a fund contemplated in section 10(1)(d)(i) or (ii) of the

Par (w) – Real Estate Investment Trust (REIT) or controlled

Act (pension fund, pension preservation fund, provident fund,

property company (cash) dividends received or accrued on or

provident preservation fund, retirement annuity fund, beneficiary

before 31 December 2013

fund or benefit fund)

Par (g) - a person contemplated in section 10(1)(t) of the Act

Par (y) – Double Taxation Agreement

(CSIR, SANRAL etc)

Par (i) – a small business funding entity as contemplated in

Par (z) – Other international agreement

section 10(1)(cQ)

DECLARATION in terms of sections 64FA(1)(a)(i), 64G(2)(a)(aa) or 64H(2)(a)(aa) of the Act:

I

(print full names),

the undersigned hereby declare that dividends paid to the beneficial owner are exempt, or would have been exempt had it not been a

in specie,

distribution of an asset

from the dividends tax in terms of the paragraph of section 64F of the Act indicated above.

Signature_______________________________________ Date ___________________________________

(Duly authorised to do so)

Capacity of Signatory _____________________________________________________________________

UNDERTAKING in terms of sections 64FA(1)(a)(ii), 64G(2)(a)(bb) or 64H(2)(a)(bb) of the Act:

I

(full names in print please),

the undersigned undertake to forthwith inform the Withholding Agent in writing should the circumstances of the beneficial owner referred

to in the declaration above change.

___________________________________

Signature_______________________________________ Date

(Duly authorised to do so)

_____________________________________________

Capacity of Signatory:

NOTE: I am aware that it is the sole responsibility of the Beneficial Owner to ensure that this declaration and undertaking are filed timeously and

that the information provided in this declaration and undertaking is accurate and complete; I agree that the Regulated Intermediary will under no

circumstances be liable for any costs, expenses or damages including, but not limited to, any direct, indirect, special, consequential or incidental

damages caused by or arising from any late submission of declarations and/or omission to submit declarations and/or any incorrect or incomplete

information provided by the Beneficial Owner in the declarations; I agree that it remains at all times the sole responsibility of the Beneficial Owner

to ensure that it complies with all requirements and obligations in relation to Dividends Tax as set out in the Act from time to time.

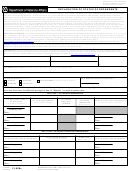

1

1 2

2 3

3