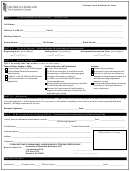

SSN: ____________________________________________

Page 2

COMPLETION REQUIRED

BY ALL EXCEPT PERMANENT RESIDENTS.

Visa Detail History

Calendar Year (CY) = January 1 to December 31.

LIST ALL PERIODS OF STAY IN THE U.S. SINCE 01/01/1986 (attach additional paper if needed)

HAVE YOU

NUMBER OF

PERIODS PHYSICALLY

VISA

TAKEN ANY

If J visa holder,

DAYS PRESENT

PRESENT IN THE U.S.

TYPE

TAX TREATY

enter Exchange

IN THE U.S.

(example: 01/01/01-

or

BENEFITS IN

Visitor Category

DURING THE

12/31/01)

other

THIS LISTED

from #4 of the

YEAR

status

YEAR?

DS-2019:

↓

↓

F OR J VISAS

CAN JUST ENTER A

□

□

CURRENT CY

YES

NO

2013

□

□

PREVIOUS CY

YES

NO

2012

□

□

2 YEARS AGO

YES

NO

2011

□

□

3 YEARS AGO

YES

NO

2010

□

□

4 YEARS AGO

YES

NO

2009

□

□

5 YEARS AGO

YES

NO

2008

□

□

6 YEARS AGO

YES

NO

2007

□

□

7 YEARS AGO

YES

NO

2006

*** For F and J visa holders ONLY: Presence for any part of a year counts as a full year.

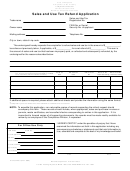

DETERMINATION OF RESIDENCY STATUS FOR TAX WITHHOLDING:

A. F-1 OR J-1 STUDENT: Have you been present in the U.S. as a student or trainee during any part of 5

EXEMPT

□

□

FROM THE

or fewer years?

YES

NO=resident alien for tax purposes.

SUBSTANTIAL

B. J-2 SPOUSE/DEPENDENT OF STUDENTS: Have you been present in the U.S. as a spouse or

PRESENCE TEST

(SPT)

□

□

dependent of an F-1 student during any part of 5 or fewer years?

YES

NO

F or J

C. J-1 PROFESSOR OR TEACHER or RESEARCHER (NON-STUDENT VISITORS): Within the period

CLASSIFICATIONS

of the previous six (6) calendars years: were you either entirely absent from the U.S. or were you

ONLY

present in the U.S. as a professor, teacher, or researcher for only 1 calendar year prior to the current

(The 5 year student

□

□

year?

YES

NO= resident alien for tax purposes.

exemption from the SPT

is available over a

D. J-2 SPOUSE/DEPENDENT OF J-1 NON-STUDENT VISITORS: within the period of the previous six

student’s lifetime, and is

(6) calendars years: were you either entirely absent from the U.S. or were you present in the U.S. for

a one-time exemption

□

□

only 1 calendar year prior to the current year?

YES

NO

only!)

If you answered “YES” to any of the questions above & as a spouse or dependent you have

included your individual years of presence if different from the primary visa holder, you are a

“NONRESIDENT ALIEN (NRA) for tax purposes”. You do NOT need to complete the SPT below.

SUBSTANTIAL

CALCULATE THE NUMBER OF DAYS PHYSICALLY PRESENT IN THE U.S. DURING THE YEARS

PRESENCE TEST (SPT)

LISTED. (VISA TYPES “A” & “G” REMAIN NRAs FOR TAX PURPOSES)

If “TOTAL” is less than

List calendar year

Number of days physically Computation

183, you are NRA for tax

Present in the U.S.

for the Test

purposes.

If “TOTAL” is more than

Current year

______2013_____

____________________ ÷

1 = ____________

or equal to 183, and you

have been in the US 31

Last year

______2012_____

____________________ ÷

3 = ____________

days in this CY, you a

Resident Alien for Tax

2 years ago

______2011______

____________________

÷

6 = ____________

Purposes.

TOTAL

……………….

2

1

1 2

2 3

3