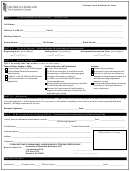

Certification to be completed by the NRA individual:

I certify that to the best of my knowledge, all of the information I have provided is true, correct, and

complete.

I understand that if my status changes from that which I have indicated on this form, I must submit a

new Citizenship Status Form to the Payroll Department.

--------------------------------------------------------/------------------------------------/------------------------------/-------------------

Signature

SSN or SID

UID

Date

THIS SECTION MUST BE COMPLETED BY THE DEPARTMENT REPRESENTATIVE

.

PURPOSE FOR SUBMITTING THIS FORM.

Department Information:

(CHECK ONE):

YEARLY RENEWAL

Department:

UMCES-IMET

Changing to valid SSN

Contact person (print name):

Lisa Ross

New to the University

Phone number of contact person:

410-221-2017

Changing Immigration Status

Notes:

NRA Fellow

Other:

I hereby certify that I have reviewed this CSF, the copies of supporting documents, and the required tax forms for completeness &

accuracy.

↑

Date ↑

Signature

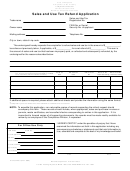

General Information for Nonresident Aliens

Social Security Taxes (FICA): Students holding an F-1 or J1 visa are exempt from FICA for the first 5 CALENDAR YEARS (CYs) they are in the U.S. A

student is exempt from FICA during any term in which he/she is registered for at least half time and is regularly attending classes, regardless of resident or

nonresident status. FICA must be withheld in any term the resident alien student is not registered at least half time and is not regularly attending classes,

such as during the summer months. Social Security taxes are not withheld on (non-service) fellowships for F-1&* J-1visa holders. Teachers and

researchers holding a J-1 visa are exempt from FICA for either the first 2 CYs they are in the U.S. or for 2 out of the last 6 CYs in the U.S. Once a NRA

becomes eligible for the SPT (page 2) and eventually meets its requirements, he/she becomes a resident alien for tax purposes and FICA withholding

st

begins retroactive to January 1

of the CY in which the substantial presence is established. H-1 visa holders are always FICA taxable.

Social Security Number: All nonresident alien employees must have a valid Social Security Number. NRA fellows must have a SSN or an ITIN.

State of Maryland Income Taxes: NRAs pay State of Maryland Income taxes, unless they are a resident of D.C., Virginia, or Pennsylvania. There are no

treaty articles exempting nonresident aliens from Maryland Income taxes.

Federal Income Taxes: Nonresident aliens may be exempt from Federal Income Taxes if they are from a country with a Tax Treaty that grants such an

exemption. Tax treaties may contain exemptions that are dependent on the type of payment, type of employee, amount of payment, and/or length of stay

in United States. The common types of payments are: wages or compensation, fellowships, honorariums, and Independent Contractor (I/C) fees. Wages

may be paid to employees who are students, undergraduate or graduate, and researchers or teachers. Treaty articles applicable to students generally

exempt only a portion of the wages (the first $2,000 to $9,000 annually depending on the country of residence) from taxation for 4 or 5 CYs. Assuming

there is an applicable treaty article, all wages paid to employees whose primary function is to teach or conduct research will generally be exempt for a two

or three year period. Fellowships may be paid to undergraduate or graduate students as grants-in-aid for which no services are required.

Procedures for processing honorariums and I/C fees are available from Payroll Services.

Page 3

07-12-2012.

3

1

1 2

2 3

3