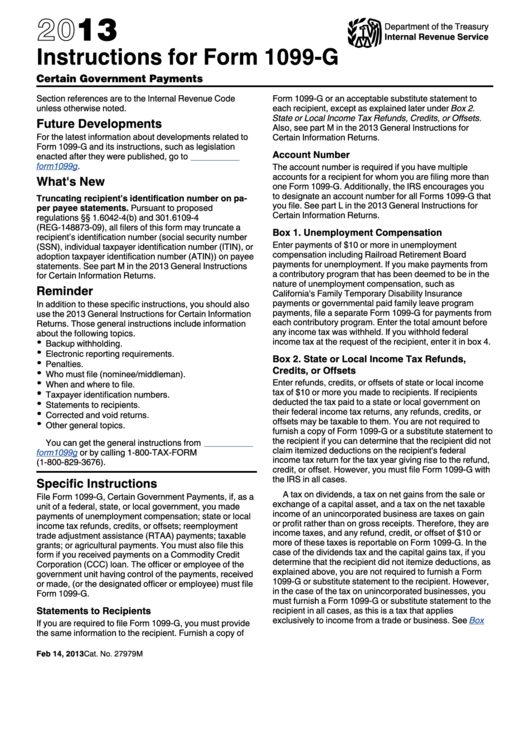

Instructions For Form 1099g -Certain Government Payments - 2013

ADVERTISEMENT

2013

Department of the Treasury

Internal Revenue Service

Instructions for Form 1099-G

Certain Government Payments

Section references are to the Internal Revenue Code

Form 1099-G or an acceptable substitute statement to

unless otherwise noted.

each recipient, except as explained later under Box 2.

State or Local Income Tax Refunds, Credits, or Offsets.

Future Developments

Also, see part M in the 2013 General Instructions for

For the latest information about developments related to

Certain Information Returns.

Form 1099-G and its instructions, such as legislation

Account Number

enacted after they were published, go to

form1099g.

The account number is required if you have multiple

accounts for a recipient for whom you are filing more than

What's New

one Form 1099-G. Additionally, the IRS encourages you

to designate an account number for all Forms 1099-G that

Truncating recipient’s identification number on pa-

you file. See part L in the 2013 General Instructions for

per payee statements. Pursuant to proposed

Certain Information Returns.

regulations §§ 1.6042-4(b) and 301.6109-4

(REG-148873-09), all filers of this form may truncate a

Box 1. Unemployment Compensation

recipient’s identification number (social security number

Enter payments of $10 or more in unemployment

(SSN), individual taxpayer identification number (ITIN), or

compensation including Railroad Retirement Board

adoption taxpayer identification number (ATIN)) on payee

payments for unemployment. If you make payments from

statements. See part M in the 2013 General Instructions

a contributory program that has been deemed to be in the

for Certain Information Returns.

nature of unemployment compensation, such as

Reminder

California's Family Temporary Disability Insurance

payments or governmental paid family leave program

In addition to these specific instructions, you should also

payments, file a separate Form 1099-G for payments from

use the 2013 General Instructions for Certain Information

each contributory program. Enter the total amount before

Returns. Those general instructions include information

any income tax was withheld. If you withhold federal

about the following topics.

income tax at the request of the recipient, enter it in box 4.

Backup withholding.

Electronic reporting requirements.

Box 2. State or Local Income Tax Refunds,

Penalties.

Credits, or Offsets

Who must file (nominee/middleman).

Enter refunds, credits, or offsets of state or local income

When and where to file.

tax of $10 or more you made to recipients. If recipients

Taxpayer identification numbers.

deducted the tax paid to a state or local government on

Statements to recipients.

their federal income tax returns, any refunds, credits, or

Corrected and void returns.

offsets may be taxable to them. You are not required to

Other general topics.

furnish a copy of Form 1099-G or a substitute statement to

the recipient if you can determine that the recipient did not

You can get the general instructions from

claim itemized deductions on the recipient's federal

form1099g

or by calling 1-800-TAX-FORM

income tax return for the tax year giving rise to the refund,

(1-800-829-3676).

credit, or offset. However, you must file Form 1099-G with

the IRS in all cases.

Specific Instructions

A tax on dividends, a tax on net gains from the sale or

File Form 1099-G, Certain Government Payments, if, as a

exchange of a capital asset, and a tax on the net taxable

unit of a federal, state, or local government, you made

income of an unincorporated business are taxes on gain

payments of unemployment compensation; state or local

or profit rather than on gross receipts. Therefore, they are

income tax refunds, credits, or offsets; reemployment

income taxes, and any refund, credit, or offset of $10 or

trade adjustment assistance (RTAA) payments; taxable

more of these taxes is reportable on Form 1099-G. In the

grants; or agricultural payments. You must also file this

case of the dividends tax and the capital gains tax, if you

form if you received payments on a Commodity Credit

determine that the recipient did not itemize deductions, as

Corporation (CCC) loan. The officer or employee of the

explained above, you are not required to furnish a Form

government unit having control of the payments, received

1099-G or substitute statement to the recipient. However,

or made, (or the designated officer or employee) must file

in the case of the tax on unincorporated businesses, you

Form 1099-G.

must furnish a Form 1099-G or substitute statement to the

Statements to Recipients

recipient in all cases, as this is a tax that applies

exclusively to income from a trade or business. See

Box

If you are required to file Form 1099-G, you must provide

the same information to the recipient. Furnish a copy of

Feb 14, 2013

Cat. No. 27979M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2