UHC Form 048

Rev. 04/28/16

Page 1 of 3

UTAH HOUSING CORPORATION

RECAPTURE NOTICE

Borrower:

Mortgage Lender:

Borrower:

Date:

Your mortgage loan (“the Mortgage Loan”) which is financing the purchase of your home (“the Residence”) will be funded with proceeds of tax-

exempt bonds ( “the Bonds”), issued by the Utah Housing Corporation (“UHC”). The Internal Revenue Code of 1986, as amended ( “the Code”)

requires, under certain circumstances, that if you sell or otherwise dispose of an interest in the Residence within nine years after your Mortgage

Loan closing (the “Closing Date”), then your federal income tax liability for the year in which you sell or dispose of the Residence may be

increased (such increase to be referred to herein as the “Recapture Amount”).

.

NOTE: Refinancing your Mortgage Loan will not eliminate your potential Recapture obligation

The Federally Subsidized Amount with respect to your Mortgage Loan is $

_________ (which is 6.25% times the original

principal amount of your Mortgage Loan [does not include First Home Plus second mortgage]). This amount is also the maximum amount by

which your tax may be increased (the “Maximum Recapture”). The Maximum Recapture may be reduced based on three factors determined

when you sell or dispose of the Residence:

A.

“Holding Period Percentage” determined by the date you sell the Residence;

B.

“Income Percentage” determined by your income and family size when you sell the Residence; and

C.

“Gain Limitation” determined by the amount of your gain from the sale of the Residence.

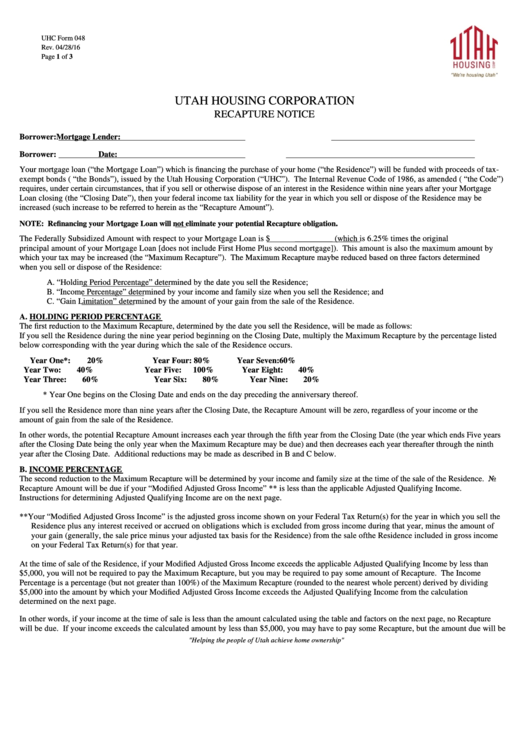

A. HOLDING PERIOD PERCENTAGE

The first reduction to the Maximum Recapture, determined by the date you sell the Residence, will be made as follows:

If you sell the Residence during the nine year period beginning on the Closing Date, multiply the Maximum Recapture by the percentage listed

below corresponding with the year during which the sale of the Residence occurs.

Year One*:

20%

Year Four:

80%

Year Seven:

60%

Year Two:

40%

Year Five:

100%

Year Eight:

40%

Year Three:

60%

Year Six:

80%

Year Nine:

20%

* Year One begins on the Closing Date and ends on the day preceding the anniversary thereof.

If you sell the Residence more than nine years after the Closing Date, the Recapture Amount will be zero, regardless of your income or the

amount of gain from the sale of the Residence.

In other words, the potential Recapture Amount increases each year through the fifth year from the Closing Date (the year which ends Five years

after the Closing Date being the only year when the Maximum Recapture may be due) and then decreases each year thereafter through the ninth

year after the Closing Date. Additional reductions may be made as described in B and C below.

B. INCOME PERCENTAGE

The second reduction to the Maximum Recapture will be determined by your income and family size at the time of the sale of the Residence. No

Recapture Amount will be due if your “Modified Adjusted Gross Income” ** is less than the applicable Adjusted Qualifying Income.

Instructions for determining Adjusted Qualifying Income are on the next page.

**Your “Modified Adjusted Gross Income” is the adjusted gross income shown on your Federal Tax Return(s) for the year in which you sell the

Residence plus any interest received or accrued on obligations which is excluded from gross income during that year, minus the amount of

your gain (generally, the sale price minus your adjusted tax basis for the Residence) from the sale of the Residence included in gross income

on your Federal Tax Return(s) for that year.

At the time of sale of the Residence, if your Modified Adjusted Gross Income exceeds the applicable Adjusted Qualifying Income by less than

$5,000, you will not be required to pay the Maximum Recapture, but you may be required to pay some amount of Recapture. The Income

Percentage is a percentage (but not greater than 100%) of the Maximum Recapture (rounded to the nearest whole percent) derived by dividing

$5,000 into the amount by which your Modified Adjusted Gross Income exceeds the Adjusted Qualifying Income from the calculation

determined on the next page.

In other words, if your income at the time of sale is less than the amount calculated using the table and factors on the next page, no Recapture

will be due. If your income exceeds the calculated amount by less than $5,000, you may have to pay some Recapture, but the amount due will be

"Helping the people of Utah achieve home ownership"

1

1 2

2 3

3