Reset Form

Print Form

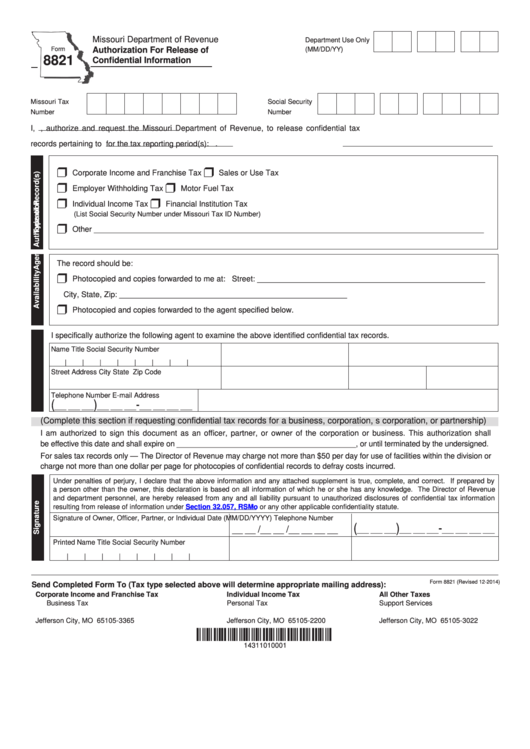

Missouri Department of Revenue

Department Use Only

Authorization For Release of

Form

(MM/DD/YY)

8821

Confidential Information

Missouri Tax I.D.

Social Security

Number

Number

I,

, authorize and request the Missouri Department of Revenue, to release confidential tax

records pertaining to

for the tax reporting period(s):

.

r

r

Corporate Income and Franchise Tax

Sales or Use Tax

r

r

Employer Withholding Tax

Motor Fuel Tax

r

r

Individual Income Tax

Financial Institution Tax

(List Social Security Number under Missouri Tax ID Number)

r

Other _________________________________________________________________________________________

The record should be:

r

Photocopied and copies forwarded to me at: Street: ____________________________________________________

City, State, Zip: ____________________________________________________

r

Photocopied and copies forwarded to the agent specified below.

I specifically authorize the following agent to examine the above identified confidential tax records.

Name

Title

Social Security Number

|

|

|

|

|

|

|

|

Street Address

City

State

Zip Code

Telephone Number

E-mail Address

(

)

-

___ ___ ___

___ ___ ___

___ ___ ___ ___

(Complete this section if requesting confidential tax records for a business, corporation, s corporation, or partnership)

I am authorized to sign this document as an officer, partner, or owner of the corporation or business. This authorization shall

be effective this date and shall expire on __________________________________________, or until terminated by the undersigned.

For sales tax records only — The Director of Revenue may charge not more than $50 per day for use of facilities within the division or

charge not more than one dollar per page for photocopies of confidential records to defray costs incurred.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. If prepared by

a person other than the owner, this declaration is based on all information of which he or she has any knowledge. The Director of Revenue

and department personnel, are hereby released from any and all liability pursuant to unauthorized disclosures of confidential tax information

resulting from release of information under

Section 32.057, RSMo

or any other applicable confidentiality statute.

Signature of Owner, Officer, Partner, or Individual

Date (MM/DD/YYYY)

Telephone Number

(

)

-

__ __ /__ __ /__ __ __ __

___ ___ ___

___ ___ ___

___ ___ ___ ___

Printed Name

Title

Social Security Number

|

|

|

|

|

|

|

|

Form 8821 (Revised 12-2014)

Send Completed Form To (Tax type selected above will determine appropriate mailing address):

Corporate Income and Franchise Tax

Individual Income Tax

All Other Taxes

Business Tax

Personal Tax

Support Services

P.O. Box 3365

P.O. Box 2200

P.O. Box 3022

Jefferson City, MO 65105-3365

Jefferson City, MO 65105-2200

Jefferson City, MO 65105-3022

14311010001

14311010001

1

1