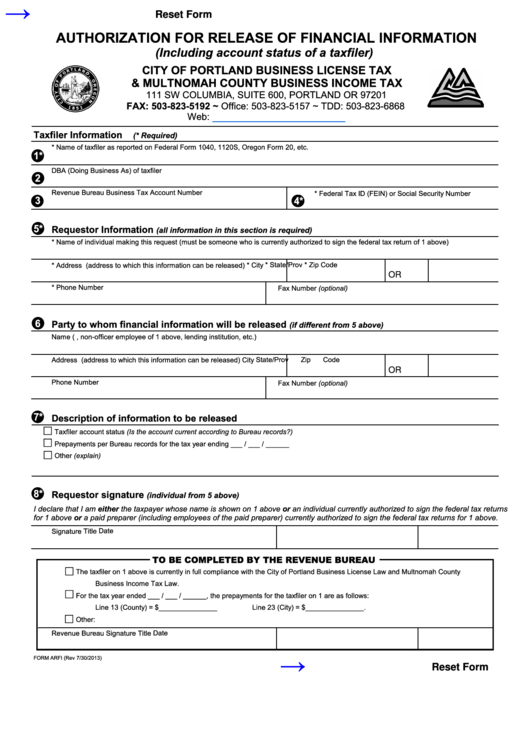

→

Reset Form

Print & Sign to Submit

AUTHORIZATION FOR RELEASE OF FINANCIAL INFORMATION

(Including account status of a taxfiler)

CITY OF PORTLAND BUSINESS LICENSE TAX

& MULTNOMAH COUNTY BUSINESS INCOME TAX

111 SW COLUMBIA, SUITE 600, PORTLAND OR 97201

FAX: 503-823-5192 ~ Office: 503-823-5157 ~ TDD: 503-823-6868

Web:

Taxfiler Information

(* Required)

* Name of taxfiler as reported on Federal Form 1040, 1120S, Oregon Form 20, etc.

1*

DBA (Doing Business As) of taxfiler

2

Revenue Bureau Business Tax Account Number

* Federal Tax ID (FEIN) or Social Security Number

3

4*

5*

Requestor Information

(all information in this section is required)

* Name of individual making this request (must be someone who is currently authorized to sign the federal tax return of 1 above)

* City

* State/Prov

* Zip Code

* Address (address to which this information can be released)

OR

* Phone Number

Fax Number (optional)

6

Party to whom financial information will be released

(if different from 5 above)

Name (e.g., non-officer employee of 1 above, lending institution, etc.)

State/Prov

Zip Code

Address (address to which this information can be released)

City

OR

Phone Number

Fax Number (optional)

7*

Description of information to be released

Taxfiler account status (Is the account current according to Bureau records?)

Prepayments per Bureau records for the tax year ending ___ / ___ / ______

Other (explain)

8*

Requestor signature

(individual from 5 above)

I declare that I am either the taxpayer whose name is shown on 1 above or an individual currently authorized to sign the federal tax returns

for 1 above or a paid preparer (including employees of the paid preparer) currently authorized to sign the federal tax returns for 1 above.

Title

Date

Signature

TO BE COMPLETED BY THE REVENUE BUREAU

The taxfiler on 1 above is currently in full compliance with the City of Portland Business License Law and Multnomah County

Business Income Tax Law.

For the tax year ended ___ / ___ / ______, the prepayments for the taxfiler on 1 are as follows:

Line 13 (County) = $_______________

Line 23 (City) = $_______________.

Other:

Date

Revenue Bureau Signature

Title

→

FORM ARFI (Rev 7/30/2013)

Reset Form

Print & Sign to Submit

1

1