Preparing Estate Tax Returns Seminar Registration Form

ADVERTISEMENT

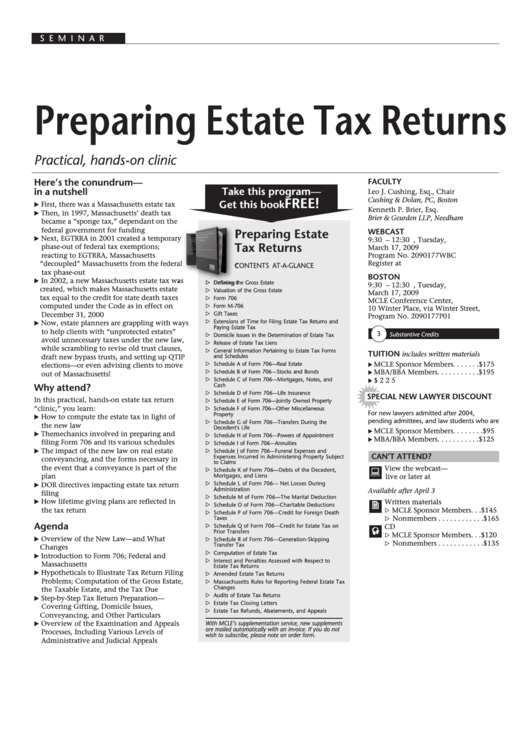

S E M I N A R

Preparing Estate Tax Returns

Practical, hands-on clinic

Here’s the conundrum—

FACULTY

Take this program—

in a nutshell

Leo J. Cushing, Esq., Chair

Cushing & Dolan, PC, Boston

FREE!

Get this book

First, there was a Massachusetts estate tax

Kenneth P. Brier, Esq.

Then, in 1997, Massachusetts’ death tax

Brier & Geurden LLP, Needham

became a “sponge tax,” dependant on the

federal government for funding

WEBCAST

Preparing Estate

Next, EGTRRA in 2001 created a temporary

9:30 a.m. – 12:30 p.m., Tuesday,

Tax Returns

phase-out of federal tax exemptions;

March 17, 2009

reacting to EGTRRA, Massachusetts

Program No. 2090177WBC

Register at

“decoupled” Massachusetts from the federal

CONTENTS AT-A-GLANCE

tax phase-out

BOSTON

In 2002, a new Massachusetts estate tax was

Defining the Gross Estate

9:30 a.m. – 12:30 p.m., Tuesday,

created, which makes Massachusetts estate

Valuation of the Gross Estate

March 17, 2009

tax equal to the credit for state death taxes

Form 706

MCLE Conference Center,

computed under the Code as in effect on

Form M-706

10 Winter Place, via Winter Street,

Gift Taxes

December 31, 2000

Program No. 2090177P01

Extensions of Time for Filing Estate Tax Returns and

Now, estate planners are grappling with ways

Paying Estate Tax

to help clients with “unprotected estates”

3

Substantive redits

Domicile Issues in the Determination of Estate Tax

avoid unnecessary taxes under the new law,

Release of Estate Tax Liens

while scrambling to revise old trust clauses,

General Information Pertaining to Estate Tax Forms

TUITION

includes written materials

draft new bypass trusts, and setting up QTIP

and Schedules

MCLE Sponsor Members . . . . . . .$175

Schedule A of Form 706—Real Estate

elections—or even advising clients to move

Schedule B of Form 706—Stocks and Bonds

MBA/BBA Members . . . . . . . . . . .$195

out of Massachusetts!

Schedule C of Form 706—Mortgages, Notes, and

All Others . . . . . . . . . . . . . . . . . . .$225

Cash

Why attend?

Schedule D of Form 706—Life Insurance

SPECI L NEW L WYER DISCOUNT

In this practical, hands-on estate tax return

Schedule E of Form 706—Jointly Owned Property

“clinic,” you learn:

Schedule F of Form 706—Other Miscellaneous

For new lawyers admitted after 2004,

Property

How to compute the estate tax in light of

pending admittees, and law students who are

Schedule G of Form 706—Transfers During the

the new law

Decedent's Life

MCLE Sponsor Members . . . . . . . .$95

The mechanics involved in preparing and

Schedule H of Form 706—Powers of Appointment

MBA/BBA Members . . . . . . . . . . .$125

filing Form 706 and its various schedules

Schedule I of Form 706—Annuities

The impact of the new law on real estate

Schedule J of Form 706—Funeral Expenses and

CAN’T ATTEND?

Expenses Incurred in Administering Property Subject

conveyancing, and the forms necessary in

to Claims

the event that a conveyance is part of the

View the webcast—

Schedule K of Form 706—Debts of the Decedent,

plan

Mortgages, and Liens

live or later at

Schedule L of Form 706— Net Losses During

DOR directives impacting estate tax return

Administration

Available after April 3

filing

Schedule M of Form 706—The Marital Deduction

How lifetime giving plans are reflected in

Written materials

Schedule O of Form 706—Charitable Deductions

the tax return

MCLE Sponsor Members . . .$145

Schedule P of Form 706—Credit for Foreign Death

Nonmembers . . . . . . . . . . . .$165

Taxes

Agenda

Schedule Q of Form 706—Credit for Estate Tax on

CD

Prior Transfers

MCLE Sponsor Members . . .$120

Overview of the New Law—and What

Schedule R of Form 706—Generation-Skipping

Nonmembers . . . . . . . . . . . .$135

Transfer Tax

Changes

Computation of Estate Tax

Introduction to Form 706; Federal and

Interest and Penalties Assessed with Respect to

Massachusetts

Estate Tax Returns

Hypotheticals to Illustrate Tax Return Filing

Amended Estate Tax Returns

Problems; Computation of the Gross Estate,

Massachusetts Rules for Reporting Federal Estate Tax

Changes

the Taxable Estate, and the Tax Due

Audits of Estate Tax Returns

Step-by-Step Tax Return Preparation—

Estate Tax Closing Letters

Covering Gifting, Domicile Issues,

Estate Tax Refunds, Abatements, and Appeals

Conveyancing, and Other Particulars

Overview of the Examination and Appeals

With MCLE’s supplementation service, new supplements

are mailed automatically with an invoice. If you do not

Processes, Including Various Levels of

wish to subscribe, please note on order form.

Administrative and Judicial Appeals

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2