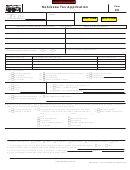

Benefits Change Form - University Of Nebraska Page 2

ADVERTISEMENT

BENEFITS CHANGE FORM INSTRUCTIONS

Use this Benefits Change Form to add, delete or change your University of Nebraska benefits. Contact your Campus Benefits Office

for additional information or questions regarding benefit coverage and costs.

You are eligible for university provided benefits under the NUFlex program if you are employed in a "Regular position” with an FTE of .5

or greater or employed in a "Temporary position" for more than 6 months with an FTE of .5 or greater.

Review your benefits materials carefully. Complete the “Option Number” and “Coverage Category” choices and any Flexible

Spending Account contributions in Section 7.

If you elect not to have coverage in one or more benefit plans, or if you wish to increase or add insurance coverage for you or any

dependent(s) in the future, you and/or any dependent(s) proposed for coverage may need to satisfy proof of insurability as required by

the insurance company.

Under the current tax law, your benefit selections are in force for the balance of the calendar year. You may make changes only if you

experience a qualified change in status. For information on what constitutes a qualified change in status, see the detailed benefits

information at Any application for changes and/or additions of coverage as well as related documentation

must be received by your Campus Benefits Office within 31 days of the qualified change in status event. Once your Benefits Change

Form has been submitted to the Campus Benefits Office, no changes will be allowed until the next annual NUFlex enrollment period or

.

a Permitted Election Change Event Occurs

New employees may apply for any medical option. No medical option changes will be

permitted except during the annual NUFlex enrollment period.

Your payroll deductions for certain university provided benefits are salary reductions under the Flexible Benefits Plan. This means that

you will not pay federal or state income tax or Social Security tax on the cost of these benefits. Because your premiums for these

benefits are tax-exempt, you save on taxes which reduces the net cost to you. However, the following types of coverage are not

offered under the Flexible Benefits Plan, do not qualify for pre-tax treatment, and are paid for with after-tax dollars: long term care

insurance, voluntary life insurance, dependent life insurance, and family AD&D insurance.

Please print clearly and complete the forms in ink, not pencil. Begin by filling in your name (last name first), Campus Address, Campus

Phone Number, University ID Number and Email Address.

1.

Administrative Unit: Check the administrative unit to which you report. This is not always the same as the campus on which you

are located. Check UNL (University of Nebraska-Lincoln), IANR (Institute of Agriculture and Natural Resources), UNMC (University

of Nebraska Medical Center), UNO (University of Nebraska at Omaha), UNK (University of Nebraska at Kearney), or UNCA

(Central Administration and Computing Services).

2.

Pay Cycle: Check One-biweekly if you are paid every two weeks, monthly if you are paid monthly.

3.

Change in Status: Check whether your request to change benefits is due to an employee or dependent change and write in the

date of the status change. The status change must be a qualified change in status event under the Internal Revenue Code

regulations.

For information on what constitutes a qualified change in status, see the detailed benefits information at

Indicate the qualified change in status event (i.e., change in legal marital status, change in number of

tax dependents, change in employment status, etc.). You must attach documentation to support the status change.

4.

Effective Date: Indicate the date your benefits are to begin. This will be the first of the month following the date of the benefit

change.

Spouse Employment: Check only if your spouse is currently employed by the University of Nebraska. Include your spouse’s

5.

name and Social Security Number in the spaces provided. If your spouse is employed by the university, the cost of your benefits

may be reduced by contributions from your spouse’s department. Contact your Campus Benefits Office for more information.

6.

Tobacco/Nicotine Designation Change:

Complete the Tobacco/Nicotine Designation if you are changing your current

tobacco/nicotine designation. Indicate Yes (have used tobacco or nicotine within the last 12 months) or No (have not used any

form of tobacco or nicotine within the last 12 months). If you indicated No, include the date you quit using tobacco/nicotine; or if

you have never used tobacco/nicotine, indicate “never used.”

7.

NUFlex Choices: Complete the appropriate Option Numbers and Coverage Category. The corresponding price tags for these

selections are shown on the NUFlex Price Tag Summary. For Flexible Spending Account salary reductions, enter the total annual

amount you want deducted through December 31. Health Care Flexible Spending Account elections may not be reduced during

the calendar year.

SIGNATURE REQUIREMENTS

8.

Employee Signature: The application must be signed by you.

T:DietzeFormsNUFlexBenefits Change Form.doc

January 15, 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2