Kentucky Mercer County Net Profits License Fee Return

ADVERTISEMENT

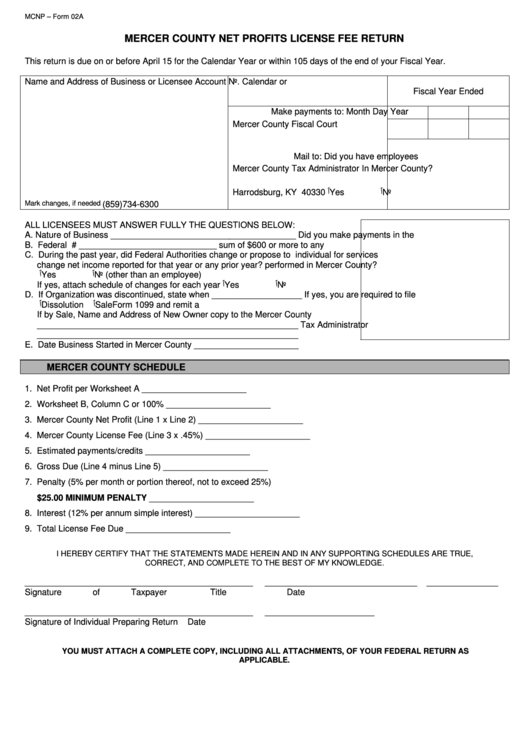

MCNP – Form 02A

MERCER COUNTY NET PROFITS LICENSE FEE RETURN

This return is due on or before April 15 for the Calendar Year or within 105 days of the end of your Fiscal Year.

Name and Address of Business or Licensee

Account No.

Calendar or

Fiscal Year Ended

Make payments to:

Month

Day

Year

Mercer County Fiscal Court

Mail to:

Did you have employees

Mercer County Tax Administrator

In Mercer County?

P.O. Box 265

ٱYes

ٱNo

Harrodsburg, KY 40330

Mark changes, if needed

(859)734-6300

ALL LICENSEES MUST ANSWER FULLY THE QUESTIONS BELOW:

A. Nature of Business _______________________________________

Did you make payments in the

B. Federal I.D. or Social Security # _____________________________

sum of $600 or more to any

C. During the past year, did Federal Authorities change or propose to

individual for services

change net income reported for that year or any prior year?

performed in Mercer County?

ٱYes

ٱNo

(other than an employee)

ٱYes

ٱNo

If yes, attach schedule of changes for each year

D. If Organization was discontinued, state when ___________________

If yes, you are required to file

ٱDissolution

ٱSale

Form 1099 and remit a

If by Sale, Name and Address of New Owner

copy to the Mercer County

_______________________________________________________

Tax Administrator

_______________________________________________________

E. Date Business Started in Mercer County ______________________

MERCER COUNTY SCHEDULE

1. Net Profit per Worksheet A

______________________

2. Worksheet B, Column C or 100%

______________________

3. Mercer County Net Profit (Line 1 x Line 2)

______________________

4. Mercer County License Fee (Line 3 x .45%)

______________________

5. Estimated payments/credits

______________________

6. Gross Due (Line 4 minus Line 5)

______________________

7. Penalty (5% per month or portion thereof, not to exceed 25%)

$25.00 MINIMUM PENALTY

______________________

8. Interest (12% per annum simple interest)

______________________

9. Total License Fee Due

______________________

I HEREBY CERTIFY THAT THE STATEMENTS MADE HEREIN AND IN ANY SUPPORTING SCHEDULES ARE TRUE,

CORRECT, AND COMPLETE TO THE BEST OF MY KNOWLEDGE.

________________________________________________

________________________________

_______________

Signature of Taxpayer

Title

Date

________________________________________________

_______________________

Signature of Individual Preparing Return

Date

YOU MUST ATTACH A COMPLETE COPY, INCLUDING ALL ATTACHMENTS, OF YOUR FEDERAL RETURN AS

APPLICABLE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2