Sample Policies For Reimbursements

ADVERTISEMENT

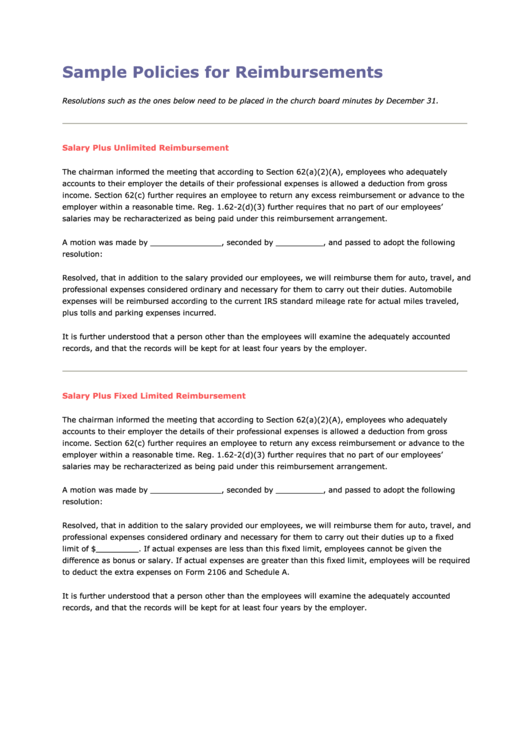

Sample Policies for Reimbursements

Resolutions such as the ones below need to be placed in the church board minutes by December 31.

Salary Plus Unlimited Reimbursement

The chairman informed the meeting that according to Section 62(a)(2)(A), employees who adequately

accounts to their employer the details of their professional expenses is allowed a deduction from gross

income. Section 62(c) further requires an employee to return any excess reimbursement or advance to the

employer within a reasonable time. Reg. 1.62-2(d)(3) further requires that no part of our employees’

salaries may be recharacterized as being paid under this reimbursement arrangement.

A motion was made by _______________, seconded by __________, and passed to adopt the following

resolution:

Resolved, that in addition to the salary provided our employees, we will reimburse them for auto, travel, and

professional expenses considered ordinary and necessary for them to carry out their duties. Automobile

expenses will be reimbursed according to the current IRS standard mileage rate for actual miles traveled,

plus tolls and parking expenses incurred.

It is further understood that a person other than the employees will examine the adequately accounted

records, and that the records will be kept for at least four years by the employer.

Salary Plus Fixed Limited Reimbursement

The chairman informed the meeting that according to Section 62(a)(2)(A), employees who adequately

accounts to their employer the details of their professional expenses is allowed a deduction from gross

income. Section 62(c) further requires an employee to return any excess reimbursement or advance to the

employer within a reasonable time. Reg. 1.62-2(d)(3) further requires that no part of our employees’

salaries may be recharacterized as being paid under this reimbursement arrangement.

A motion was made by _______________, seconded by __________, and passed to adopt the following

resolution:

Resolved, that in addition to the salary provided our employees, we will reimburse them for auto, travel, and

professional expenses considered ordinary and necessary for them to carry out their duties up to a fixed

limit of $_________. If actual expenses are less than this fixed limit, employees cannot be given the

difference as bonus or salary. If actual expenses are greater than this fixed limit, employees will be required

to deduct the extra expenses on Form 2106 and Schedule A.

It is further understood that a person other than the employees will examine the adequately accounted

records, and that the records will be kept for at least four years by the employer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3