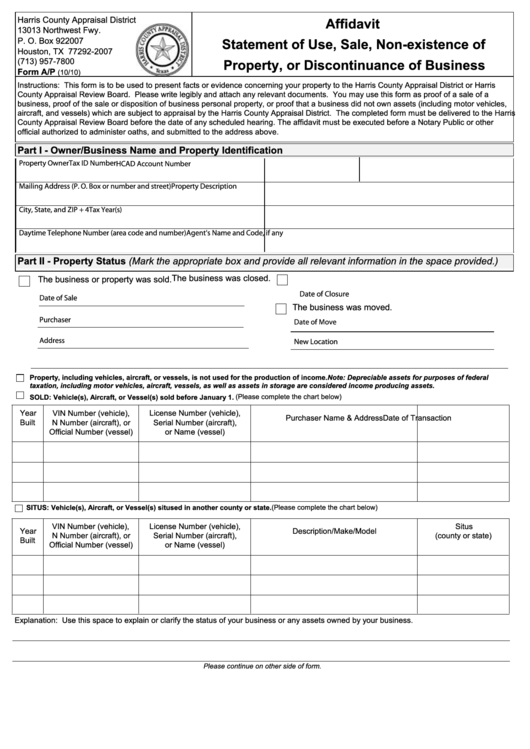

Harris County Appraisal District

Affidavit

13013 Northwest Fwy.

P. O. Box 922007

Statement of Use, Sale, Non-existence of

Houston, TX 77292-2007

(713) 957-7800

Property, or Discontinuance of Business

Form A/P

(10/10)

Instructions: This form is to be used to present facts or evidence concerning your property to the Harris County Appraisal District or Harris

County Appraisal Review Board. Please write legibly and attach any relevant documents. You may use this form as proof of a sale of a

business, proof of the sale or disposition of business personal property, or proof that a business did not own assets (including motor vehicles,

aircraft, and vessels) which are subject to appraisal by the Harris County Appraisal District. The completed form must be delivered to the Harris

County Appraisal Review Board before the date of any scheduled hearing. The affidavit must be executed before a Notary Public or other

official authorized to administer oaths, and submitted to the address above.

Part I - Owner/Business Name and Property Identification

Tax ID Number

Property Owner

HCAD Account Number

Mailing Address (P. O. Box or number and street)

Property Description

City, State, and ZIP + 4

Tax Year(s)

Agent's Name and Code, if any

Daytime Telephone Number (area code and number)

Part II - Property Status (Mark the appropriate box and provide all relevant information in the space provided.)

The business was closed.

The business or property was sold.

Date of Closure

Date of Sale

The business was moved.

Purchaser

Date of Move

Address

New Location

Property, including vehicles, aircraft, or vessels, is not used for the production of income. Note: Depreciable assets for purposes of federal

taxation, including motor vehicles, aircraft, vessels, as well as assets in storage are considered income producing assets.

SOLD: Vehicle(s), Aircraft, or Vessel(s) sold before January 1.

(Please complete the chart below)

Year

VIN Number (vehicle),

License Number (vehicle),

Purchaser Name & Address

Date of Transaction

Built

N Number (aircraft), or

Serial Number (aircraft),

Official Number (vessel)

or Name (vessel)

SITUS: Vehicle(s), Aircraft, or Vessel(s) sitused in another county or state. (Please complete the chart below)

VIN Number (vehicle),

License Number (vehicle),

Situs

Year

Description/Make/Model

N Number (aircraft), or

Serial Number (aircraft),

(county or state)

Built

Official Number (vessel)

or Name (vessel)

Explanation: Use this space to explain or clarify the status of your business or any assets owned by your business.

Please continue on other side of form.

1

1 2

2