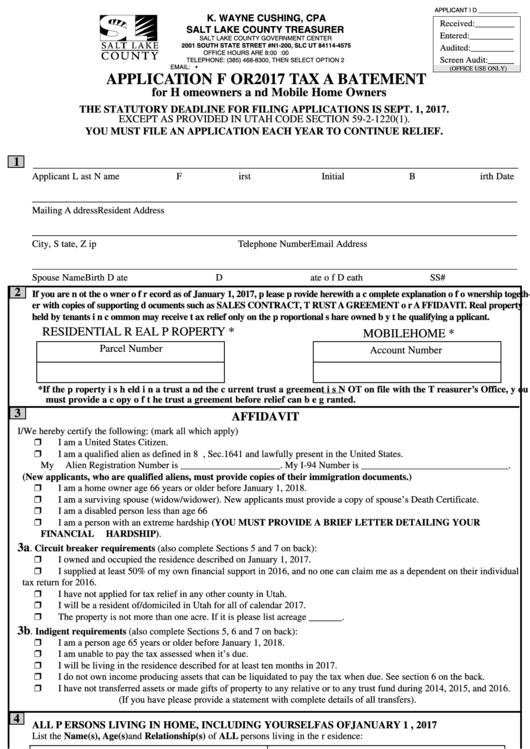

APPLICANT ID ____________

K. WAYNE CUSHING, CPA

Received:_________

SALT LAKE COUNTY TREASURER

Entered: __________

SALT LAKE COUNTY GOVERNMENT CENTER

2001 SOUTH STATE STREET #N1-200, SLC UT 84114-4575

Audited:__________

OFFICE HOURS ARE 8:00 A.M. TO 5:00 P.M.

Screen Audit:______

TELEPHONE: (385) 468-8300, THEN SELECT OPTION 2

EMAIL: •

(OFFICE USE ONLY)

APPLICATION FOR 2017 TAX ABATEMENT

for Homeowners and Mobile Home Owners

THE STATUTORY DEADLINE FOR FILING APPLICATIONS IS SEPT. 1, 2017.

EXCEPT AS PROVIDED IN UTAH CODE SECTION 59-2-1220(1).

YOU MUST FILE AN APPLICATION EACH YEAR TO CONTINUE RELIEF.

1

______________________________________________________________________________________________________

Applicant Last Name

First

Initial

Birth Date

SS#

______________________________________________________________________________________________________

Mailing Address

Resident Address

______________________________________________________________________________________________________

City, State, Zip

Telephone Number

Email Address

______________________________________________________________________________________________________

Spouse Name

Birth Date

Date of Death

SS#

2

If you are not the owner of record as of January 1, 2017, please provide herewith a complete explanation of ownership togeth-

er with copies of supporting documents such as SALES CONTRACT, TRUST AGREEMENT or AFFIDAVIT. Real property

held by tenants in common may receive tax relief only on the proportional share owned by the qualifying applicant.

RESIDENTIAL REAL PROPERTY *

MOBILE HOME *

Parcel Number

Account Number

* If the property is held in a trust and the current trust agreement is NOT on file with the Treasurer’s Office, you

must provide a copy of the trust agreement before relief can be granted.

3

AFFIDAVIT

I/We hereby certify the following: (mark all which apply)

Ì I am a United States Citizen.

Ì I am a qualified alien as defined in 8 U.S.C., Sec.1641 and lawfully present in the United States.

My Alien Registration Number is _____________________. My I-94 Number is _______________________________.

(New applicants, who are qualified aliens, must provide copies of their immigration documents.)

Ì I am a home owner age 66 years or older before January 1, 2018.

Ì I am a surviving spouse (widow/widower). New applicants must provide a copy of spouse’s Death Certificate.

Ì I am a disabled person less than age 66

Ì I am a person with an extreme hardship (YOU MUST PROVIDE A BRIEF LETTER DETAILING YOUR

FINANCIAL HARDSHIP).

3a

. Circuit breaker requirements (also complete Sections 5 and 7 on back):

Ì I owned and occupied the residence described on January 1, 2017.

Ì I supplied at least 50% of my own financial support in 2016, and no one can claim me as a dependent on their individual

tax return for 2016.

Ì I have not applied for tax relief in any other county in Utah.

Ì I will be a resident of/domiciled in Utah for all of calendar 2017.

Ì The property is not more than one acre. If it is please list acreage _______.

3b

. Indigent requirements (also complete Sections 5, 6 and 7 on back):

Ì I am a person age 65 years or older before January 1, 2018.

Ì I am unable to pay the tax assessed when it’s due.

Ì I will be living in the residence described for at least ten months in 2017.

Ì I do not own income producing assets that can be liquidated to pay the tax when due. See section 6 on the back.

Ì I have not transferred assets or made gifts of property to any relative or to any trust fund during 2014, 2015, and 2016.

(If you have please provide a statement with complete details of all transfers).

4

ALL PERSONS LIVING IN HOME, INCLUDING YOURSELF AS OF JANUARY 1, 2017

List the Name(s), Age(s) and Relationship(s) of ALL persons living in the residence:

Name

Age e

Self

Name

Age

Relationship

Name

Age

Relationship

Name

Age

Relationship

Name

Age

Relationship

Name

Age

Relationship

Name

Age

Relationship

Name

Age

Relationship

Continue on reverse side (Sections 5-7)

Code(s):

1

1 2

2