Stax1 Application For Sales Tax Exemption - Illinois

ADVERTISEMENT

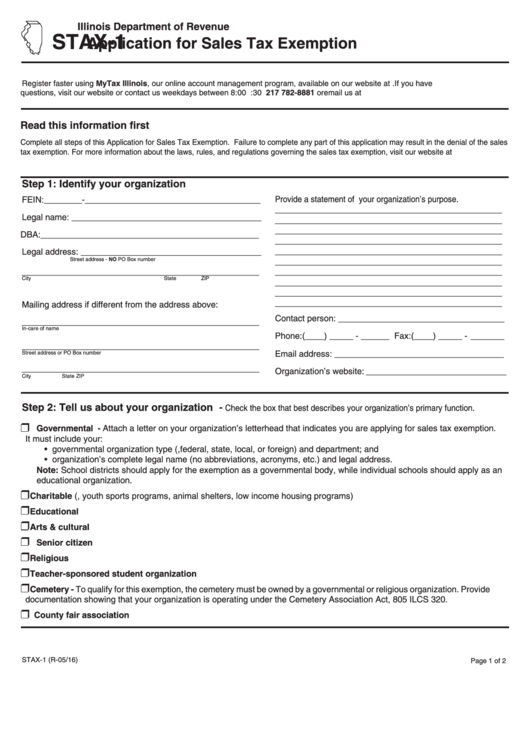

Illinois Department of Revenue

STAX-1

Application for Sales Tax Exemption

Register faster using MyTax Illinois, our online account management program, available on our website at tax.illinois.gov. If you have

questions, visit our website or contact us weekdays between 8:00 a.m. and 4:30 p.m. at 217 782-8881 or email us at rev.e99@illinois.gov.

Read this information first

Complete all steps of this Application for Sales Tax Exemption. Failure to complete any part of this application may result in the denial of the sales

tax exemption. For more information about the laws, rules, and regulations governing the sales tax exemption, visit our website at tax.illinois.gov.

Step 1: Identify your organization

Provide a statement of your organization’s purpose.

FEIN:________-_____________________________________

____________________________________________________

Legal name: ________________________________________

____________________________________________________

____________________________________________________

DBA:______________________________________________

____________________________________________________

____________________________________________________

Legal address: ______________________________________

Street address - NO PO Box number

____________________________________________________

__________________________________________________

____________________________________________________

City

State

ZIP

____________________________________________________

____________________________________________________

____________________________________________________

Mailing address if different from the address above:

Contact person: ___________________________________

__________________________________________________

In-care of name

Phone:(____) _____ - ______ Fax:(____) _____ - _______

__________________________________________________

Email address: ___________________________________

Street address or PO Box number

__________________________________________________

Organization’s website: _____________________________

City

State

ZIP

Step 2: Tell us about your organization -

Check the box that best describes your organization’s primary function.

Governmental - Attach a letter on your organization’s letterhead that indicates you are applying for sales tax exemption.

It must include your:

• governmental organization type (e.g., federal, state, local, or foreign) and department; and

• organization’s complete legal name (no abbreviations, acronyms, etc.) and legal address.

Note: School districts should apply for the exemption as a governmental body, while individual schools should apply as an

educational organization.

Charitable (e.g., youth sports programs, animal shelters, low income housing programs)

Educational

Arts & cultural

Senior citizen

Religious

Teacher-sponsored student organization

Cemetery - To qualify for this exemption, the cemetery must be owned by a governmental or religious organization. Provide

documentation showing that your organization is operating under the Cemetery Association Act, 805 ILCS 320.

County fair association

STAX-1 (R-05/16)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2