Moving Expense Tax Form

ADVERTISEMENT

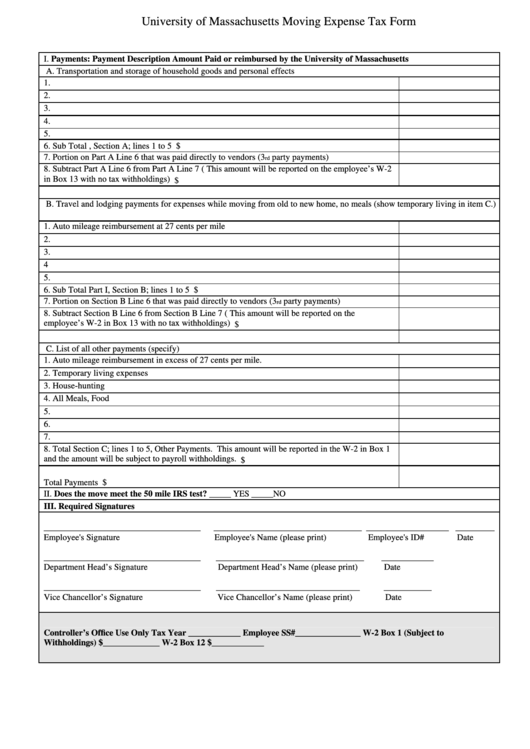

University of Massachusetts Moving Expense Tax Form

I. Payments: Payment Description Amount Paid or reimbursed by the University of Massachusetts

A. Transportation and storage of household goods and personal effects

1.

2.

3.

4.

5.

6. Sub Total , Section A; lines 1 to 5

$

7. Portion on Part A Line 6 that was paid directly to vendors (3

party payments)

rd

8. Subtract Part A Line 6 from Part A Line 7 ( This amount will be reported on the employee’s W-2

in Box 13 with no tax withholdings)

$

B. Travel and lodging payments for expenses while moving from old to new home, no meals (show temporary living in item C.)

1. Auto mileage reimbursement at 27 cents per mile

2.

3.

4

5.

6. Sub Total Part I, Section B; lines 1 to 5

$

7. Portion on Section B Line 6 that was paid directly to vendors (3

party payments)

rd

8. Subtract Section B Line 6 from Section B Line 7 ( This amount will be reported on the

employee’s W-2 in Box 13 with no tax withholdings)

$

C. List of all other payments (specify)

1. Auto mileage reimbursement in excess of 27 cents per mile.

2. Temporary living expenses

3. House-hunting

4. All Meals, Food

5.

6.

7.

8. Total Section C; lines 1 to 5, Other Payments. This amount will be reported in the W-2 in Box 1

and the amount will be subject to payroll withholdings.

$

Total Payments

$

II. Does the move meet the 50 mile IRS test? _____ YES _____NO

III. Required Signatures

____________________________________

__________________________________ ___________________ _________

Employee's Signature

Employee's Name (please print)

Employee's ID#

Date

____________________________________

__________________________________

____________

Department Head’s Signature

Department Head’s Name (please print)

Date

____________________________________

_________________________________

___________

Vice Chancellor’s Signature

Vice Chancellor’s Name (please print)

Date

Controller’s Office Use Only Tax Year ____________ Employee SS#_______________ W-2 Box 1 (Subject to

Withholdings) $_____________ W-2 Box 12 $____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2