Debt Sustainability Analysis Page 2

ADVERTISEMENT

•

Potential financing needs for the banking sector have increased considerably. The capital

situation of Greek banks is coming under increasing pressure due to worsening asset quality

that is related to the significantly weaker macro-economic development, high political

uncertainty, the delayed NPL resolution process and the significant adverse impact of capital

controls on economic activity and payment culture. In view of this banks will face substantial

capital needs. As they will likely have no market access in the near future, an adequate

capital backstop as part of a next financial assistance programme is needed. The estimated

size of the required capital backstop amounts to EUR 25 bn. Further work on the calibration

and terms of such capital backstop is currently ongoing based on an asset quality review and

stress test to be undertaken over the coming weeks by the ECB.

•

The projections do not include the transfers to Greece equivalent to SMP and ANFA profits

up to 2026 following the statements of the Eurogroup whereby the agreement related to

these transfers expired with the EFSF programme.

Based on the developments above and the implementation of the programme, the debt-to-GDP ratio

in the baseline scenario A is expected to increase to 201% in 2016 before going down to 175% in

2020, 160% in 2022 and 122% in 2030..

In the scenario B based on partial programme implementation, it is assumed that privatisation

receipts total only EUR 3.7 bn between 2015-2022, growth is lower by 0.5 pp. per year compared to

the baseline scenario and the primary fiscal targets are lower at: -1% of GDP in 2015, 0% in 2016,

1.5% in 2017, 2% in 2018 and 3.5% from 2019 onwards. Based on these assumptions the debt-to-

GDP ratio would increase to 207% in 2016, before falling to 186% in 2020, 174% in 2022 and 143% in

2030.

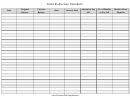

Table 1. Greece: debt-to-GDP in the three scenarios

2015

2016

2017

2018

2019

2020

2022

2030

Scenario A

196,3

200,9

198,6

190,7

182,3

174,5

159,7

122,2

Scenario B

198,8

206,8

205,2

199,5

192,4

185,9

173,7

143,3

Scenario C

195,4

198,9

195,2

186,1

176,0

166,1

148,2

106,7

Scenario C is based on better outcomes, growth is assumed to be 0.5 pp higher compared to the

baseline and privatisation revenue would total EUR 24.6 bn over 2015-2022 as it would include

revenue from the privatisation of banks of EUR 10 bn. In this case the debt-to-GDP ratio would

increase to 199% in 2016 before falling to 166% in 2020, 148% in 2022 and 107% in 2030.

In all three scenarios examined the debt-to-GDP ratio in 2020 and 2022 would be substantially above

the 2012 targets of “124% in 2020 and substantially below 110% in 2022”.

However, focusing exclusively on the debt-to-GDP level does not allow capturing the structure of

debt and is not accounting entirely for the measures taken by the European financial support. This

aspect can be better assessed by the gross financing needs of a country, which captures its payment

structure over time. Lower gross financing needs reduce rollover and financial stability risks. Greece

currently benefits from very low debt servicing in the period up to 2023 due to low interest rates,

interest deferral and a long grace period on both GLF and EFSF loans. As in the case of the debt-to-

GDP ratio it is also difficult to determine concrete thresholds for this alternative metric above which

public debt should be considered as no longer being sustainable. Based on cross country evidence, an

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3