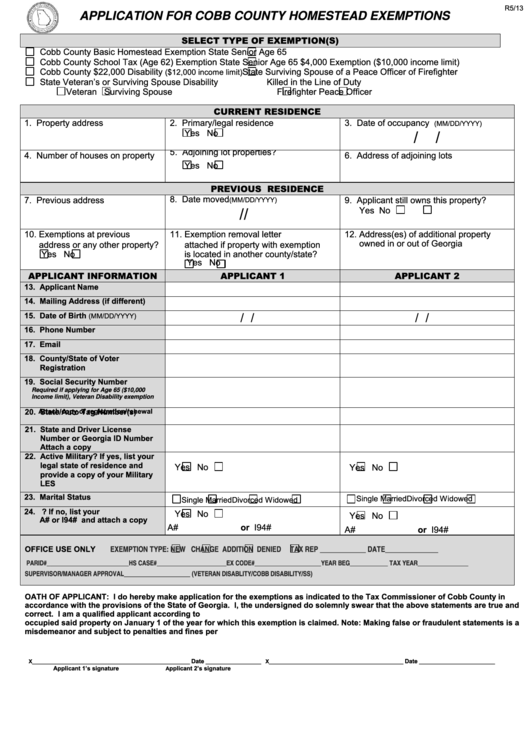

R5/13

APPLICATION FOR COBB COUNTY HOMESTEAD EXEMPTIONS

SELECT TYPE OF EXEMPTION(S)

Cobb County Basic Homestead Exemption

State Senior Age 65

Cobb County School Tax (Age 62) Exemption

State Senior Age 65 $4,000 Exemption ($10,000 income limit)

Cobb County $22,000 Disability

State Surviving Spouse of a Peace Officer of Firefighter

($12,000 income limit)

State Veteran’s or Surviving Spouse Disability

Killed in the Line of Duty

Veteran

Surviving Spouse

Firefighter

Peace Officer

CURRENT RESIDENCE

1. Property address

2. Primary/legal residence

3. Date of occupancy

(MM/DD/YYYY)

/

/

Yes

No

4. Number of houses on property

5. Adjoining lot properties?

6. Address of adjoining lots

Yes

No

PREVIOUS RESIDENCE

7. Previous address

8. Date moved

9. Applicant still owns this property?

(MM/DD/YYYY)

/

/

Yes

No

10. Exemptions at previous

11. Exemption removal letter

12. Address(es) of additional property

address or any other property?

attached if property with exemption

owned in or out of Georgia

Yes

No

is located in another county/state?

Yes

No

APPLICANT INFORMATION

APPLICANT 1

APPLICANT 2

13. Applicant Name

14. Mailing Address (if different)

/

/

/

/

15. Date of Birth

(MM/DD/YYYY)

16. Phone Number

17. Email

18. County/State of Voter

Registration

19. Social Security Number

Required if applying for Age 65 ($10,000

Income limit), Veteran Disability exemption

20. State/Auto Tag Number(s)

Attach copy of registration/renewal

21. State and Driver License

Number or Georgia ID Number

Attach a copy

22. Active Military? If yes, list your

legal state of residence and

Yes

No

Yes

No

provide a copy of your Military

LES

23. Marital Status

Single

Married

Divorced

Widowed

Single

Married

Divorced

Widowed

24. U.S. Citizen? If no, list your

Yes

No

Yes

No

A# or I94# and attach a copy

A#

or I94#

A#

or I94#

EXEMPTION TYPE:

NEW

CHANGE

ADDITION

DENIED

TAX REP _____________ DATE_______________

OFFICE USE ONLY

PARID#__________________________HS CASE#______________________EX CODE#_____________________YEAR BEG____________ TAX YEAR________________

SUPERVISOR/MANAGER APPROVAL_____________________ (VETERAN DISABLITY/COBB DISABILITY/SS)

OATH OF APPLICANT: I do hereby make application for the exemptions as indicated to the Tax Commissioner of Cobb County in

accordance with the provisions of the State of Georgia. I, the undersigned do solemnly swear that the above statements are true and

correct. I am a qualified applicant according to O.C.G.A. 48-5-40 and the bona fide owner of the above described property. I actually

occupied said property on January 1 of the year for which this exemption is claimed. Note: Making false or fraudulent statements is a

misdemeanor and subject to penalties and fines per O.C.G.A 48-5-51.

Date

Date

X______________________________________________________

___________________

X______________________________________________

__________________________

Applicant 1’s signature

pplicant 2’s signature

A

1

1