Motor Vehicle Excise Tax Abatement Form - Town Of Plainville

ADVERTISEMENT

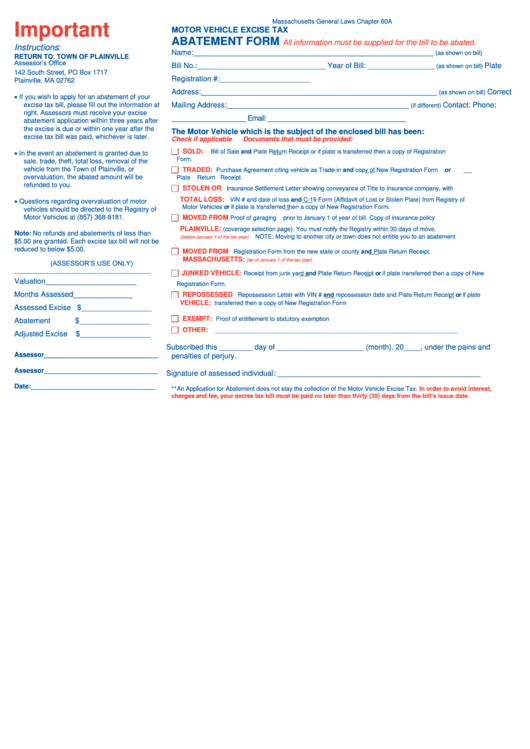

Massachusetts General Laws Chapter 60A

Important

MOTOR VEHICLE EXCISE TAX

ABATEMENT FORM

All information must be supplied for the bill to be abated.

Instructions:

Name:__________________________________________________________

(as shown on bill)

RETURN TO: TOWN OF PLAINVILLE

Assessor’s Office

Bill No.:_______________________________ Year of Bill: ________________

Plate

(as shown on bill)

142 South Street, PO Box 1717

Registration #:______________________

Plainville, MA 02762

Address:_________________________________________________________

Correct

(as shown on bill)

If you wish to apply for an abatement of your

excise tax bill, please fill out the information at

Mailing Address:____________________________________________

Contact: Phone:

(if different)

right. Assessors must receive your excise

____________________ Email: _____________________________________

abatement application within three years after

the excise is due or within one year after the

The Motor Vehicle which is the subject of the enclosed bill has been:

excise tax bill was paid, whichever is later.

Check if applicable

Documents that must be provided:

In the event an abatement is granted due to

SOLD:

Bill of Sale and Plate Return Receipt or if plate is transferred then a copy of Registration

Form.

sale, trade, theft, total loss, removal of the

vehicle from the Town of Plainville, or

TRADED:

Purchase Agreement citing vehicle as Trade-in and copy of New Registration Form

or

overvaluation, the abated amount will be

Plate Return

Receipt.

refunded to you.

STOLEN OR

Insurance Settlement Letter showing conveyance of Title to Insurance company, with

Questions regarding overvaluation of motor

TOTAL LOSS:

VIN # and date of loss and C-19 Form (Affidavit of Lost or Stolen Plate) from Registry of

Motor Vehicles or if plate is transferred then a copy of New Registration Form.

vehicles should be directed to the Registry of

Motor Vehicles at (857) 368-8181.

MOVED FROM

Proof of garaging prior to J anuary 1 of year of bill. Copy of insurance policy

PLAINVILLE:

(coverage selection page). You must notify the Registry within 30 days of move.

Note: No refunds and abatements of less than

NOTE: Moving to another city or town does not entitle you to an abatement

(before J anuary 1 of the tax year)

$5.00 are granted. Each excise tax bill will not be

.

reduced to below $5.00.

MOVED FROM

Registration Form from the new state or county and Plate Return Receipt.

MASSACHUSETTS:

(as of J anuary 1 of the tax year)

(ASSESSOR’S USE ONLY)

------------------------------------------------------------

J UNKED VEHICLE:

Receipt from junk yard and Plate Return Receipt or if plate transferred then a copy of New

Valuation______________________

Registration Form.

Months Assessed_______________

REPOSSESSED

Repossession Letter with VIN # and repossession date and Plate Return Receipt or if plate

VEHICLE:

transferred then a copy of New Registration Form

Assessed Excise $_________________

EXEMPT:

Proof of entitlement to statutory exemption

Abatement

$_________________

OTHER:

__________________________________________________________________

Adjusted Excise

$_________________

Subscribed this ________ day of _____________________ (month), 20____, under the pains and

Assessor_______________________________

penalties of perjury.

Assessor_______________________________

Signature of assessed individual: _________________________________________________

Date:__________________________________

**An Application for Abatement does not stay the collection of the Motor Vehicle Excise Tax.

In order to avoid interest,

charges and fee, your excise tax bill must be paid no later than thirty (30) days from the bill’s issue date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1