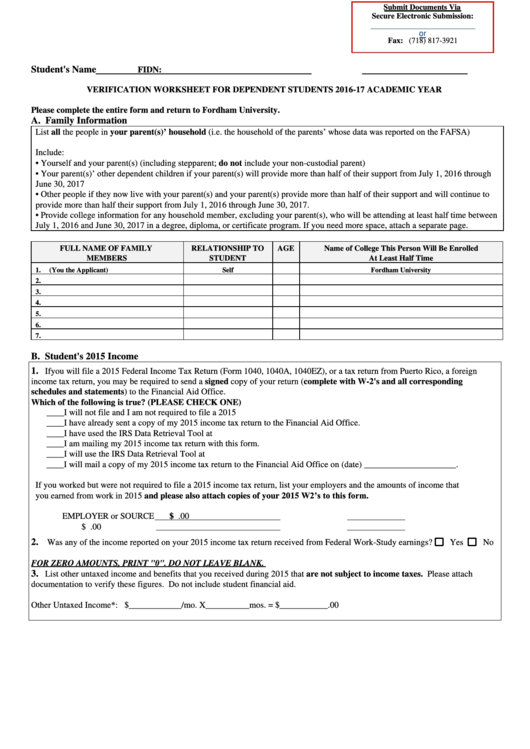

Verification Worksheet For Dependent Students

ADVERTISEMENT

Submit Documents Via

Secure Electronic Submission:

my.fordham.edu/fasubmitdocs

or

Fax: (718) 817-3921

Student's Name

FIDN:

VERIFICATION WORKSHEET FOR DEPENDENT STUDENTS 2016-17 ACADEMIC YEAR

Please complete the entire form and return to Fordham University.

A. Family Information

List all the people in your parent(s)’ household (i.e. the household of the parents’ whose data was reported on the FAFSA)

Include:

• Yourself and your parent(s) (including stepparent; do not include your non-custodial parent)

• Your parent(s)’ other dependent children if your parent(s) will provide more than half of their support from July 1, 2016 through

June 30, 2017

• Other people if they now live with your parent(s) and your parent(s) provide more than half of their support and will continue to

provide more than half their support from July 1, 2016 through June 30, 2017.

• Provide college information for any household member, excluding your parent(s), who will be attending at least half time between

July 1, 2016 and June 30, 2017 in a degree, diploma, or certificate program. If you need more space, attach a separate page.

FULL NAME OF FAMILY

RELATIONSHIP TO

AGE

Name of College This Person Will Be Enrolled

MEMBERS

STUDENT

At Least Half Time

1.

(You the Applicant)

Self

Fordham University

2.

3.

4.

5.

6.

7.

B. Student's 2015 Income

1.

If you will file a 2015 Federal Income Tax Return (Form 1040, 1040A, 1040EZ), or a tax return from Puerto Rico, a foreign

income tax return, you may be required to send a signed copy of your return (complete with W-2's and all corresponding

schedules and statements) to the Financial Aid Office.

Which of the following is true? (PLEASE CHECK ONE)

____I will not file and I am not required to file a 2015 U.S. Income Tax Return.

____I have already sent a copy of my 2015 income tax return to the Financial Aid Office.

____I have used the IRS Data Retrieval Tool at FAFSA.ed.gov to retrieve and transfer 2015 IRS income information.

____I am mailing my 2015 income tax return with this form.

____I will use the IRS Data Retrieval Tool at FAFSA.ed.gov to retrieve and transfer 2015 IRS income information.

____I will mail a copy of my 2015 income tax return to the Financial Aid Office on (date) _____________________.

If you worked but were not required to file a 2015 income tax return, list your employers and the amounts of income that

you earned from work in 2015 and please also attach copies of your 2015 W2’s to this form.

EMPLOYER or SOURCE

$

.00

$

.00

2.

Was any of the income reported on your 2015 income tax return received from Federal Work-Study earnings?

Yes

No

FOR ZERO AMOUNTS, PRINT "0". DO NOT LEAVE BLANK.

3.

List other untaxed income and benefits that you received during 2015 that are not subject to income taxes. Please attach

documentation to verify these figures. Do not include student financial aid.

Other Untaxed Income*:

$____________/mo. X__________mos. = $___________.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2