Amendment To Loan Agreement Template

ADVERTISEMENT

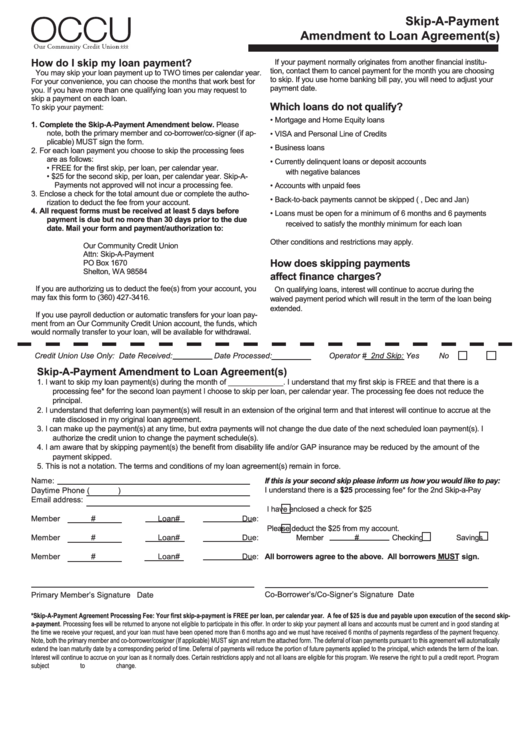

Skip-A-Payment

Amendment to Loan Agreement(s)

How do I skip my loan payment?

If your payment normally originates from another financial institu-

tion, contact them to cancel payment for the month you are choosing

You may skip your loan payment up to TWO times per calendar year.

to skip. If you use home banking bill pay, you will need to adjust your

For your convenience, you can choose the months that work best for

payment date.

you. If you have more than one qualifying loan you may request to

skip a payment on each loan.

Which loans do not qualify?

To skip your payment:

•

Mortgage and Home Equity loans

1.

Complete the Skip-A-Payment Amendment below. Please

note, both the primary member and co-borrower/co-signer (if ap-

•

VISA and Personal Line of Credits

plicable) MUST sign the form.

•

Business loans

2.

For each loan payment you choose to skip the processing fees

are as follows:

•

Currently delinquent loans or deposit accounts

• FREE for the first skip, per loan, per calendar year.

with negative balances

• $25 for the second skip, per loan, per calendar year. Skip-A-

Payments not approved will not incur a processing fee.

•

Accounts with unpaid fees

3.

Enclose a check for the total amount due or complete the autho-

•

Back-to-back payments cannot be skipped (i.e., Dec and Jan)

rization to deduct the fee from your account.

4.

All request forms must be received at least 5 days before

•

Loans must be open for a minimum of 6 months and 6 payments

payment is due but no more than 30 days prior to the due

received to satisfy the monthly minimum for each loan

date. Mail your form and payment/authorization to:

Other conditions and restrictions may apply.

Our Community Credit Union

Attn: Skip-A-Payment

How does skipping payments

PO Box 1670

Shelton, WA 98584

affect finance charges?

If you are authorizing us to deduct the fee(s) from your account, you

On qualifying loans, interest will continue to accrue during the

may fax this form to (360) 427-3416.

waived payment period which will result in the term of the loan being

extended.

If you use payroll deduction or automatic transfers for your loan pay-

ment from an Our Community Credit Union account, the funds, which

would normally transfer to your loan, will be available for withdrawal.

Credit Union Use Only: Date Received:

Date Processed:

Operator #

2nd Skip: Yes

No

Skip-A-Payment Amendment to Loan Agreement(s)

1.

I want to skip my loan payment(s) during the month of _____________. I understand that my first skip is FREE and that there is a

processing fee* for the second loan payment I choose to skip per loan, per calendar year. The processing fee does not reduce the

principal.

2.

I understand that deferring loan payment(s) will result in an extension of the original term and that interest will continue to accrue at the

rate disclosed in my original loan agreement.

3.

I can make up the payment(s) at any time, but extra payments will not change the due date of the next scheduled loan payment(s). I

authorize the credit union to change the payment schedule(s).

4.

I am aware that by skipping payment(s) the benefit from disability life and/or GAP insurance may be reduced by the amount of the

payment skipped.

5.

This is not a notation. The terms and conditions of my loan agreement(s) remain in force.

Name:

If this is your second skip please inform us how you would like to pay:

Daytime Phone (

)

I understand there is a $25 processing fee* for the 2nd Skip-a-Pay

Email address:

I have enclosed a check for $25

Member #

Loan#

Due:

Please deduct the $25 from my account.

Member #

Loan#

Due:

Member #

Checking

Savings

Member #

Loan#

Due:

All borrowers agree to the above. All borrowers MUST sign.

Primary Member’s Signature

Date

Co-Borrower’s/Co-Signer’s Signature

Date

*Skip-A-Payment Agreement Processing Fee: Your first skip-a-payment is FREE per loan, per calendar year. A fee of $25 is due and payable upon execution of the second skip-

a-payment. Processing fees will be returned to anyone not eligible to participate in this offer. In order to skip your payment all loans and accounts must be current and in good standing at

the time we receive your request, and your loan must have been opened more than 6 months ago and we must have received 6 months of payments regardless of the payment frequency.

Note, both the primary member and co-borrower/cosigner (If applicable) MUST sign and return the attached form. The deferral of loan payments pursuant to this agreement will automatically

extend the loan maturity date by a corresponding period of time. Deferral of payments will reduce the portion of future payments applied to the principal, which extends the term of the loan.

Interest will continue to accrue on your loan as it normally does. Certain restrictions apply and not all loans are eligible for this program. We reserve the right to pull a credit report. Program

subject to change.

Rev. 9/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1