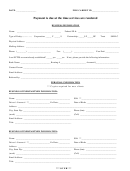

Client Info Sheet Page 4

Download a blank fillable Client Info Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Client Info Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Consumer Credit Counseling Service of Buffalo, Inc.

Statement of Counseling Services

PLEASE READ THE FOLLOWING IMPORTANT INFORMATION CAREFULLY BEFORE YOUR APPOINTMENT, SO THAT YOU UNDERSTAND THE

PROCEDURES FOR THE COUNSELING SESSION. FOR SIMPLIFICATION THE SINGULAR IS USED EVEN WHEN THE PLURAL MAY APPLY.

What Can Be Expected From CCCS of Buffalo, Inc

The Agency will provide a confidential comprehensive personal money management interview that will be conducted by

a certified consumer credit counselor or counselor in training to be certified. A certified consumer credit counselor will

review all action plans for all counselors training to be certified.

A credit report may be required to be retrieved from a national credit reporting agency. By signing this form you

authorize CCCS of Buffalo, Inc. to obtain a credit report for the basis of reviewing your financial situation.

By signing below, you also authorize CCCS of Buffalo to pull your credit report during a 1 year period from the

date of your counseling appointment in order to track outcomes and improve our services (no impact to your credit

score).

Check this box if you would like to opt out.

Services may include a brief review of your housing situation. The review may result in an overview of

government sponsored housing programs. If appropriate, services may be included under HUD/Government grants.

Your privacy is one of our highest concerns

To review our privacy policy, please visit us

.

online at

Services are offered without regard to ability to pay and services will not be withheld because of inability to pay. A

fee waiver may be obtained in cases of specific hardship based upon income and must be verified by presentment of pay

stubs and/or other proof of income.

Most of the Agency funding comes from voluntary contributions from creditors who participate in the Creditor

Repayment Plan (CRP).

Since creditors have a financial interest in getting paid, most are willing to make a contribution to help fund our

agency. These contributions are usually calculated by each creditor as a percentage of the payment (up to 15%) of each

payment received. However, your accounts with your creditors will always be credited with one hundred percent (100%)

of the amount you pay through us, and we will work with all of your creditors regardless of whether they contribute to our

agency.

You will be provided a written assessment outlining a suggested client action plan which will be based on the following options:

a) You will handle any financial concerns on your own.

b) Enrollment in a Creditor Repayment Plan (CRP), is an option but may not suitable for everyone. Our CRP's are a voluntary

program which serve a dual role of helping you repay your debts and helping the creditors to receive the money owed to them.

Your participation in a debt repayment program may change information which is already on your credit report. If your credit

report reflects that you have paid creditors as agreed in the past, a CRP could have a negative impact on a creditworthiness

decision by a potential creditor, landlord, or employer in the future. In addition, creditors may report that you are on a CRP and

are not paying as originally agreed although they have accepted the reduced payment.

c) Seek legal advice regarding your financial situation. Counselors may answer general questions regarding bankruptcy but cannot

provide legal advice. You should be aware that debts to creditors you repay through the plan may be able to be discharged

through bankruptcy. Bankruptcy is a personal choice based on individual circumstances.

d) You may be referred to the other services of the organization services (Bankruptcy Counseling, Financial Counseling, Credit

Report Review Session, Budgeting Session, Financial Education Workshops) or other agencies as appropriate that may be able to

assist with particular problems that have been identified. You have the right to use or reject referrals offered, if any.

Client Responsibilities and Bill of Rights

We pledge that our clients have the right:

To provide the Agency with accurate information to the best of their knowledge regarding all of their creditors and budget

information necessary to assess their financial situation

To receive and read the Agency brochure and the Client Handbook

To prompt counseling services for managing money based on individual financial situation

To treatment with dignity and respect

To be actively involved in a comprehensive assessment of their financial situation including an appropriate action plan.

To express dissatisfaction through a Complaint Resolution Process. A complete description of our grievance policy is

available for review at any time.

To discontinue your relationship with our agency at any time, upon proper notice.

To ask questions and to have concerns addressed.

Any contact with CCCS may be monitored and recorded for training, quality assurance and security purposes

I have read and understand all of the above information about CCCS services, funding and my rights and

responsibilities. I agree to hold CCCS, its employees, agents and volunteers harmless from any claim, suit, action

or demand of my/our creditors, my/ourselves or any other person resulting from advice or counseling. The

information I have provided to CCCS is accurate to the best of my knowledge. I understand a neutral third party

may contact me to request an evaluation of the agency's services. I understand that

that receipt of financial

counseling services does not automatically guarantee that I will participate in a Creditor Repayment Plan

program.

You will be required to sign a copy of the "Statement of Counseling" for your appointment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4