Personal Finance Worksheet

ADVERTISEMENT

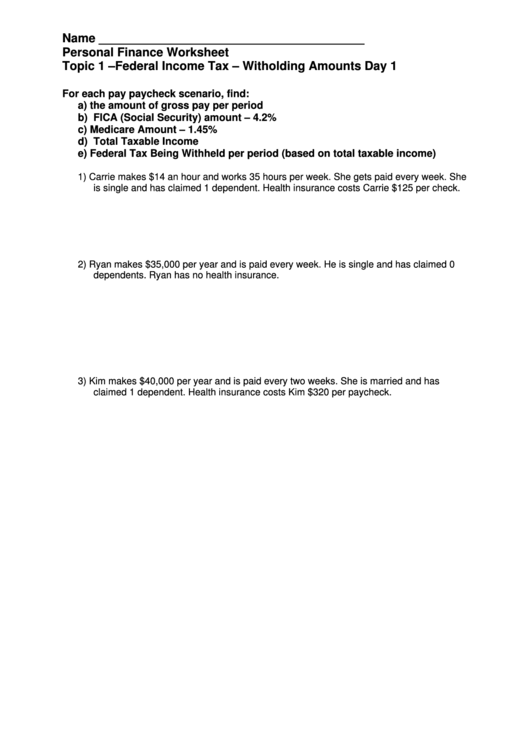

Name _______________________________________

Personal Finance Worksheet

Topic 1 –Federal Income Tax – Witholding Amounts Day 1

For each pay paycheck scenario, find:

a) the amount of gross pay per period

b) FICA (Social Security) amount – 4.2%

c) Medicare Amount – 1.45%

d) Total Taxable Income

e) Federal Tax Being Withheld per period (based on total taxable income)

1) Carrie makes $14 an hour and works 35 hours per week. She gets paid every week. She

is single and has claimed 1 dependent. Health insurance costs Carrie $125 per check.

2) Ryan makes $35,000 per year and is paid every week. He is single and has claimed 0

dependents. Ryan has no health insurance.

3) Kim makes $40,000 per year and is paid every two weeks. She is married and has

claimed 1 dependent. Health insurance costs Kim $320 per paycheck.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1