Joint Election To Split Pension Income For 2015

ADVERTISEMENT

Clear Data

Help

Protected B

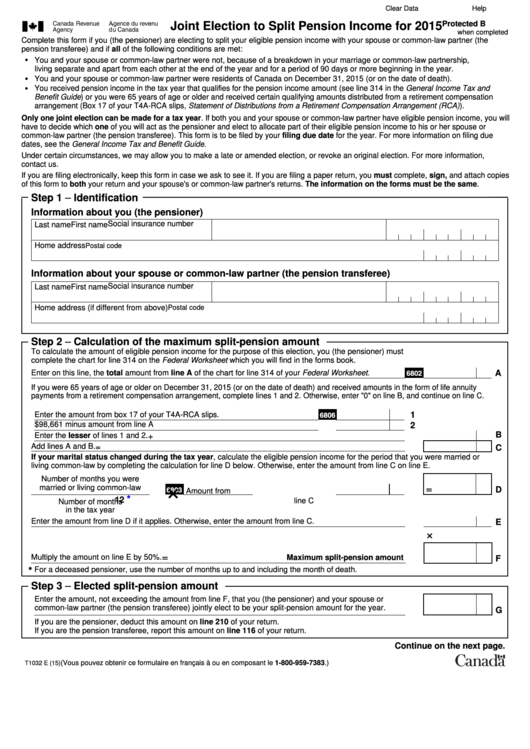

Joint Election to Split Pension Income for 2015

when completed

Complete this form if you (the pensioner) are electing to split your eligible pension income with your spouse or common-law partner (the

pension transferee) and if all of the following conditions are met:

•

You and your spouse or common-law partner were not, because of a breakdown in your marriage or common-law partnership,

living separate and apart from each other at the end of the year and for a period of 90 days or more beginning in the year.

•

You and your spouse or common-law partner were residents of Canada on December 31, 2015 (or on the date of death).

•

You received pension income in the tax year that qualifies for the pension income amount (see line 314 in the General Income Tax and

Benefit Guide) or you were 65 years of age or older and received certain qualifying amounts distributed from a retirement compensation

arrangement (Box 17 of your T4A-RCA slips, Statement of Distributions from a Retirement Compensation Arrangement (RCA)).

Only one joint election can be made for a tax year. If both you and your spouse or common-law partner have eligible pension income, you will

have to decide which one of you will act as the pensioner and elect to allocate part of their eligible pension income to his or her spouse or

common-law partner (the pension transferee). This form is to be filed by your filing due date for the year. For more information on filing due

dates, see the General Income Tax and Benefit Guide.

Under certain circumstances, we may allow you to make a late or amended election, or revoke an original election. For more information,

contact us.

If you are filing electronically, keep this form in case we ask to see it. If you are filing a paper return, you must complete, sign, and attach copies

of this form to both your return and your spouse's or common-law partner's returns. The information on the forms must be the same.

Step 1 – Identification

Information about you (the pensioner)

Social insurance number

Last name

First name

Home address

Postal code

Information about your spouse or common-law partner (the pension transferee)

Social insurance number

Last name

First name

Home address (if different from above)

Postal code

Step 2 – Calculation of the maximum split-pension amount

To calculate the amount of eligible pension income for the purpose of this election, you (the pensioner) must

complete the chart for line 314 on the Federal Worksheet which you will find in the forms book.

6802

Enter on this line, the total amount from line A of the chart for line 314 of your Federal Worksheet.

A

If you were 65 years of age or older on December 31, 2015 (or on the date of death) and received amounts in the form of life annuity

payments from a retirement compensation arrangement, complete lines 1 and 2. Otherwise, enter "0" on line B, and continue on line C.

6806

Enter the amount from box 17 of your T4A-RCA slips.

1

$98,661 minus amount from line A

2

B

Enter the lesser of lines 1 and 2.

+

Add lines A and B.

=

C

If your marital status changed during the tax year, calculate the eligible pension income for the period that you were married or

living common-law by completing the calculation for line D below. Otherwise, enter the amount from line C on line E.

Number of months you were

×

6803

married or living common-law

=

D

Amount from

*

12

line C

Number of months

in the tax year

Enter the amount from line D if it applies. Otherwise, enter the amount from line C.

E

×

=

Multiply the amount on line E by 50%.

Maximum split-pension amount

F

For a deceased pensioner, use the number of months up to and including the month of death.

*

Step 3 – Elected split-pension amount

Enter the amount, not exceeding the amount from line F, that you (the pensioner) and your spouse or

common-law partner (the pension transferee) jointly elect to be your split-pension amount for the year.

G

If you are the pensioner, deduct this amount on line 210 of your return.

If you are the pension transferee, report this amount on line 116 of your return.

Continue on the next page.

(Vous pouvez obtenir ce formulaire en français à ou en composant le 1-800-959-7383.)

T1032 E (15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2