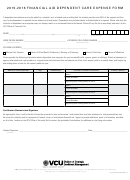

C. Parent's 2014 Income

For zero amounts, print a "0" in the blank.

[ ] Your completion of the FAFSA income section using the IRS Tax Retrieval Tool was successful, Skip this section and go to Section D below.

1.

[ ] If your parents will file a 2014 U.S. income tax return (Form 1040, 1040A, 1040EZ), you must send a signed copy of the IRS Federal Tax Return

Transcript to the SIU Financial Aid Office. Do not send your personal IRS Tax Return. Include Schedule C – Profit or Loss Statement from

Business, if they had business income. Print the student's full name and Student ID Number (Dawg Tag) on the copy.

Which of the following is true?

[ ] I have already sent a copy of my parent's 2014 U.S. federal tax return transcript to the SIU Financial Aid Office.

[ ] I am mailing my parent's signed 2014 U.S. federal tax return transcript with this form.

[ ] My parents will not file a 2014 U.S. federal tax return.

2.

If your parents worked but did not file a 2014 U.S. federal tax return, list their employers and the amounts of income that they earned from work in 2014,

and submit all W-2 forms.

3.

EMPLOYER OR SOURCE OF TAXABLE INCOME FOR 2014

_________________________________________ $________________

_______________________________________ $________________

_________________________________________ $________________

_______________________________________ $________________

D. Student's and Parent's 2014 Untaxed Income

For zero amounts, print a "0" in the blank.

List other income and benefits that you and/or your parents received during 2014 that are not subject to U.S. federal income taxes. Do not include student

financial aid.

Type of Untaxed Income/Benefit

Student's Totals for 2014 Parents' Totals for 2014

Payments to tax-deferred pension and savings plans (paid directly or withheld from earnings),

including, but not limited to, amounts reported on the w-2 forms in boxes 12a through 12d, codes

D, E, F, G, H and S.

Child support received for all children. Don't include foster care or adoption payments.

Housing, food and other living allowances paid to members of the military, clergy and others

(including cash payments and cash value of benefits). Don’t include the value of on-base military

housing or the value of a basic military allowance for housing.

Veterans' non-education benefits, such as Disability, Death Pension or Dependency & Indemnity

Compensation (DIC) or VA Educational Work-Study allowances.

Other untaxed income not reported in items 45a through 45h or 94a through 94h, such as workers’

compensation, disability, etc. Also include the untaxed portions of health savings accounts from IRS Form

1040-line 25. Don’t include extended foster care benefits, student aid, earned income credit, additional child

tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce

Investment Act educational benefits, on-base military housing or a military housing allowance, combat pay,

benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion or credit for

federal tax on special fuels.

Money received or money paid on your behalf (e.g. bills), not reported elsewhere on this form.

This includes money that you received from a parent whose financial information is not reported

on this form and that is not part of a legal child support agreement.

E. Student's and Parent's Certification and Signatures

WARNING: This form is used in the process of establishing eligibility for federal student aid funds. You should know that intentionally false

statements or misrepresentation may subject the filer to a fine or imprisonment, or both, under provisions of the United States Criminal Code.

I (we) certify that all of the information on this form is complete and correct. (At least one parent must sign below).

______________________________________________________

______________________________________________________

Student's Signature

Date

Parent's Signature

Date

Documents should be faxed to 618/453-7305. If you do not have access to a fax machine, documents can be mailed to the address on the top of

this form.

16017VFWDep: 1/16/2015

1

1 2

2