Tax And Child Support Certification Certification

ADVERTISEMENT

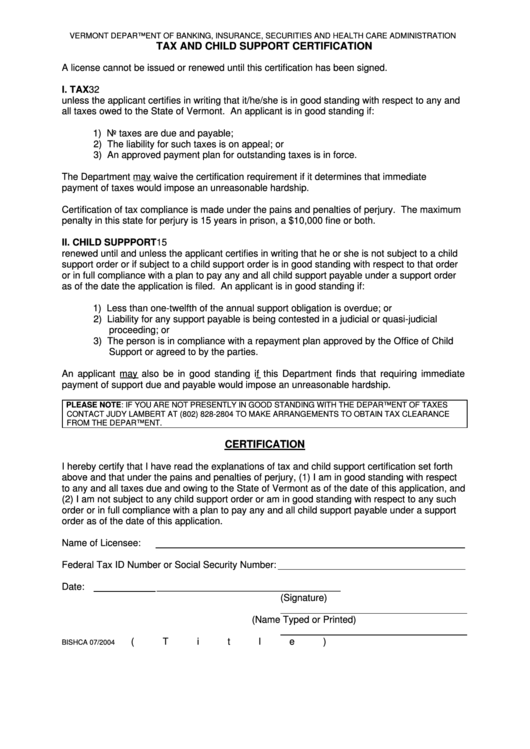

VERMONT DEPARTMENT OF BANKING, INSURANCE, SECURITIES AND HEALTH CARE ADMINISTRATION

TAX AND CHILD SUPPORT CERTIFICATION

A license cannot be issued or renewed until this certification has been signed.

I. TAX 32 V.S.A. Section 3113 provides that a license cannot be issued or renewed until and

unless the applicant certifies in writing that it/he/she is in good standing with respect to any and

all taxes owed to the State of Vermont. An applicant is in good standing if:

1) No taxes are due and payable;

2) The liability for such taxes is on appeal; or

3) An approved payment plan for outstanding taxes is in force.

The Department may waive the certification requirement if it determines that immediate

payment of taxes would impose an unreasonable hardship.

Certification of tax compliance is made under the pains and penalties of perjury. The maximum

penalty in this state for perjury is 15 years in prison, a $10,000 fine or both.

II. CHILD SUPPPORT 15 V.S.A. Section 795 provides that a license cannot be issued or

renewed until and unless the applicant certifies in writing that he or she is not subject to a child

support order or if subject to a child support order is in good standing with respect to that order

or in full compliance with a plan to pay any and all child support payable under a support order

as of the date the application is filed. An applicant is in good standing if:

1) Less than one-twelfth of the annual support obligation is overdue; or

2) Liability for any support payable is being contested in a judicial or quasi-judicial

proceeding; or

3) The person is in compliance with a repayment plan approved by the Office of Child

Support or agreed to by the parties.

An applicant may also be in good standing if this Department finds that requiring immediate

payment of support due and payable would impose an unreasonable hardship.

PLEASE NOTE: IF YOU ARE NOT PRESENTLY IN GOOD STANDING WITH THE DEPARTMENT OF TAXES

CONTACT JUDY LAMBERT AT (802) 828-2804 TO MAKE ARRANGEMENTS TO OBTAIN TAX CLEARANCE

FROM THE DEPARTMENT.

CERTIFICATION

I hereby certify that I have read the explanations of tax and child support certification set forth

above and that under the pains and penalties of perjury, (1) I am in good standing with respect

to any and all taxes due and owing to the State of Vermont as of the date of this application, and

(2) I am not subject to any child support order or am in good standing with respect to any such

order or in full compliance with a plan to pay any and all child support payable under a support

order as of the date of this application.

Name of Licensee:

Federal Tax ID Number or Social Security Number:

Date:

___________________________________

(Signature)

(Name Typed or Printed)

(Title)

BISHCA 07/2004

ADVERTISEMENT

0 votes

1

1