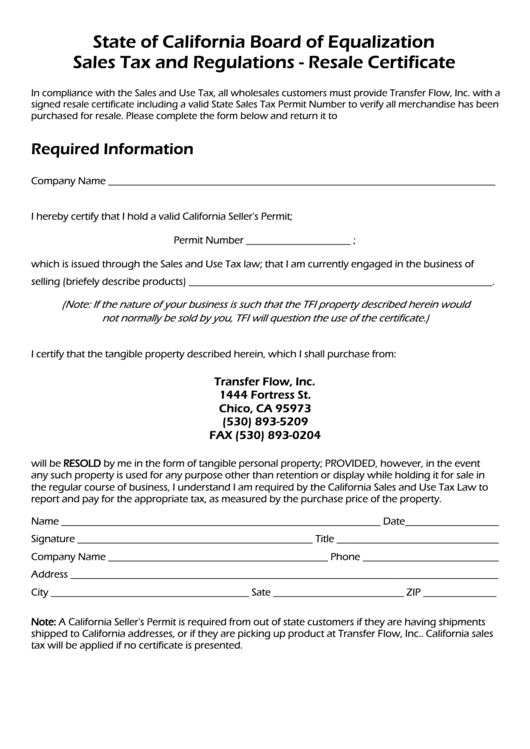

State of California Board of Equalization

Sales Tax and Regulations - Resale Certificate

In compliance with the Sales and Use Tax, all wholesales customers must provide Transfer Flow, Inc. with a

signed resale certificate including a valid State Sales Tax Permit Number to verify all merchandise has been

purchased for resale. Please complete the form below and return it to T.F.I. promptly.

Required Information

Company Name __________________________________________________________________________

I hereby certify that I hold a valid California Seller's Permit;

Permit Number ____________________ ;

which is issued through the Sales and Use Tax law; that I am currently engaged in the business of

selling (briefely describe products) __________________________________________________________.

(Note: If the nature of your business is such that the TFI property described herein would

not normally be sold by you, TFI will question the use of the certificate.)

I certify that the tangible property described herein, which I shall purchase from:

Transfer Flow, Inc.

1444 Fortress St.

Chico, CA 95973

(530) 893-5209

FAX (530) 893-0204

will be RESOLD by me in the form of tangible personal property; PROVIDED, however, in the event

any such property is used for any purpose other than retention or display while holding it for sale in

the regular course of business, I understand I am required by the California Sales and Use Tax Law to

report and pay for the appropriate tax, as measured by the purchase price of the property.

Name _____________________________________________________________ Date__________________

Signature _____________________________________________ Title _______________________________

Company Name __________________________________________ Phone __________________________

Address __________________________________________________________________________________

City ______________________________________ Sate _________________________ ZIP ______________

Note: A California Seller's Permit is required from out of state customers if they are having shipments

shipped to California addresses, or if they are picking up product at Transfer Flow, Inc.. California sales

tax will be applied if no certificate is presented.

1

1